Alright, let’s talk about Micron Technology’s earnings report . You’ve probably seen the headlines – maybe a mixed bag of results, forecasts, and analyst opinions. But, here’s the thing: the real story isn’t just about the numbers. It’s about what those numbers mean for the future of tech, the economy, and maybe even your portfolio. This isn’t just another earnings report; it’s a peek behind the curtain.

The Semiconductor Landscape | More Than Just Chips

We tend to think of semiconductors as things inside our phones and computers. Which, fair. They are. But, semiconductors – and companies like Micron – are at the heart of everything from AI development to automotive innovation. When Micron announces its earnings, it’s not just about their bottom line. It’s a health check for the entire tech ecosystem. A crucial data point for tech investors.

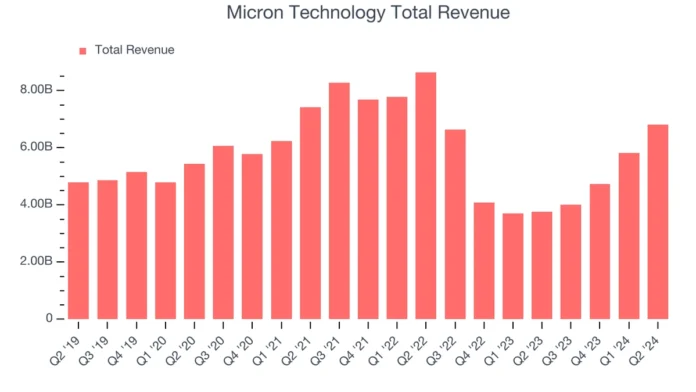

So, what makes this specific earnings report significant? Well, let’s rephrase that. The memory market, which Micron dominates, is incredibly sensitive to global demand. Think of it as a barometer. Strong Micron earnings can signal robust demand for electronics, data centers, and all the other gizmos we’re constantly buying. Weak earnings? Not so much. And right now, the market is jittery. We’re seeing inflation, supply chain woes (still!), and geopolitical tensions. Micron’s report helps paint a clearer picture amid all the uncertainty.

Decoding the Data | What to Look For

Let’s be honest, reading an earnings report can feel like deciphering ancient hieroglyphics. But don’t worry, it’s not as complicated as it looks! Here’s what I focus on:

- Revenue Trends: Are sales increasing or decreasing? And, more importantly, why? Look for commentary on market conditions and competitive pressures.

- Gross Margins: This is a key indicator of profitability. Higher margins mean Micron is selling its products at a higher premium. Lower margins could suggest increased competition or rising production costs.

- Guidance: What does Micron expect for the next quarter or year? Pay close attention to their forecasts, as they often move markets.

But, here’s the crucial part. The why behind the numbers. Did they beat expectations because of a surge in demand for data center memory? Did supply chain issues impact their ability to fulfill orders? These are the questions to dig into.

The Geopolitics of Memory | A Hidden Factor

Here’s where it gets interesting – and a little bit complicated. The semiconductor industry is heavily influenced by geopolitics. Trade wars, export restrictions, and national security concerns can all have a massive impact on companies like Micron.

The US-China relationship is a big one here. Any escalation in tensions could disrupt supply chains, limit market access, and create a whole host of other headaches for Micron. So, while you’re looking at the numbers, also keep an eye on the news headlines.

Beyond the Report | What’s Next for Micron?

So, what does all this mean for Micron’s future ? Well, there are a few key trends to watch. Artificial intelligence (AI) is driving massive demand for memory chips. As AI models become more complex, they need more and faster memory. Micron is well-positioned to benefit from this trend.

The automotive industry is another growth area. Electric vehicles (EVs) and advanced driver-assistance systems (ADAS) require a ton of memory. And, as cars become more like computers on wheels, that demand is only going to increase.

One thing I’ve learned? Never underestimate the power of innovation. Companies that can consistently develop new and improved products are the ones that thrive in the long run. It’s the key to long-term growth. Micron needs to continue investing in R&D to stay ahead of the curve.

FAQ | Micron Technology Earnings Report

What does Micron Technology actually do?

Micron designs and manufactures memory and storage solutions. Think RAM, flash memory, and SSDs.

Why is Micron’s stock price so volatile?

The memory market is cyclical. Demand and prices fluctuate, leading to volatility in Micron’s stock.

How does the current global chip shortage affect Micron?

It can both help and hurt. Higher prices due to scarcity can boost revenue, but supply chain disruptions can limit production.

Where can I find the official Micron earnings report?

Check Micron’s investor relations website (usually under the “investors” section) for the full report and related documents. According to the Micron website , you can find all the official information.

What are some of the key financial metrics to watch?

Revenue growth, gross margin, earnings per share (EPS), and free cash flow are all important.

What is earnings call?

An earnings call is a conference call between a public company’s management and analysts, investors, and the media to discuss the company’s financial results for a particular period.

Here’s the thing: Earnings reports aren’t just about past performance. They’re about future potential. By understanding the underlying trends and the strategic context, you can make more informed investment decisions. It is necessary to understand the earnings trends to know where the stock is headed. So, next time you see a headline about Micron’s earnings, don’t just scroll past it. Dig a little deeper. The story might surprise you.