Let’s be honest, the stock market can feel like a rollercoaster – and ZS stock is no exception. You see the headlines, the price swings, but what does it really mean for you? I initially thought it was just another tech stock bouncing around, but digging deeper, I realized there’s a fascinating story behind the ticker. And that’s what we’re diving into today – not just the what, but the why behind the ZS stock movements.

Understanding Zscaler’s Place in the Cybersecurity Landscape

Zscaler isn’t just another company; it’s a major player in the cloud security space. Now, I know what you might be thinking: “Cloud security? Sounds complicated.” But here’s the thing: as more and more businesses move their operations online, the need for robust cybersecurity solutions becomes absolutely critical. A common mistake I see people make is underestimating the importance of this industry. Think of it like this: if your business is a house, Zscaler is like the high-tech security system that keeps the bad guys out. And let’s be honest, in today’s digital world, there are a lot of bad guys out there.

What fascinates me is how Zscaler has adapted to the changing landscape. They don’t just offer a one-size-fits-all solution; they provide a comprehensive platform that can be tailored to meet the specific needs of different organizations. This adaptability, combined with their strong track record, is a key reason why investors are keeping a close eye on ZS stock . But, and this is a big but, the cybersecurity market is fiercely competitive. Companies like CrowdStrike and Palo Alto Networks are also vying for market share, which can create volatility in ZS stock price . It’s essential to keep this in mind.

The Factors Influencing ZS Stock Performance

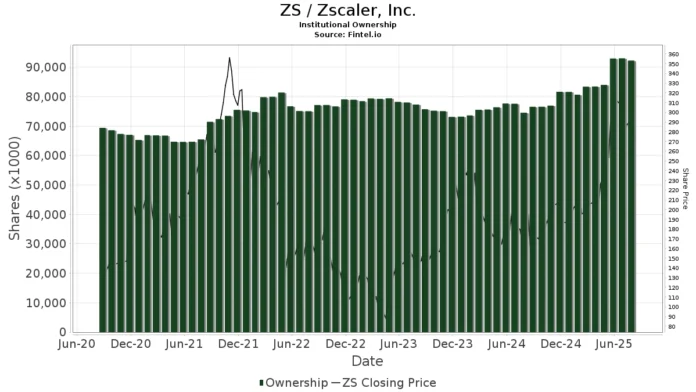

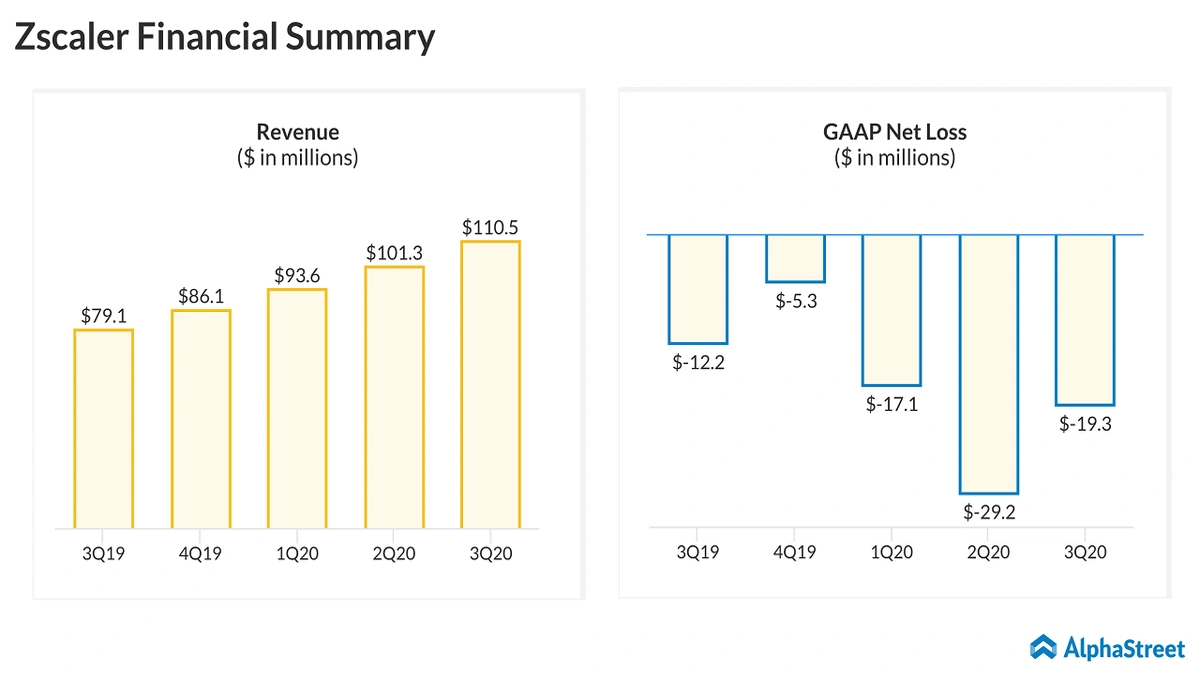

So, what actually drives the price of ZS stock? It’s a mix of factors, really. First, there’s the overall health of the economy. When the economy is doing well, businesses are more likely to invest in cybersecurity, which benefits Zscaler. But when the economy is struggling, these investments can be put on hold. Then, there’s the company’s financial performance. Are they growing their revenue? Are they profitable? These are the questions that investors are constantly asking. According to the latest Zscaler investor relations report, the company has shown consistent revenue growth. Another factor that influences ZS stock is industry trends. Are there any new cybersecurity threats emerging? Are there any new regulations that companies need to comply with? These kinds of events can have a big impact on the demand for Zscaler’s services.

Let me rephrase that for clarity: It’s not just about the numbers; it’s about the story the numbers tell. It is crucial to keep tabs onZS stock forecast. And don’t forget the influence of broader market sentiment. One should acknowledge that even the best companies aren’t immune to market-wide corrections or sector-specific downturns. External factors should be on your radar.

Analyzing ZS Stock | Key Metrics and Indicators

If you’re thinking about investing in ZS stock, it’s important to do your homework. Don’t just rely on headlines or what your neighbor told you. You need to dig into the company’s financials and understand the key metrics that drive its business. What fascinates me is how many people skip this crucial step! A common mistake I see people make is only looking at the stock price. That’s like judging a book by its cover. You need to look at things like revenue growth, profitability, and cash flow. You also need to understand the company’s competitive landscape and its market position. It is worth noting that ZS stock analysis requires an investor to follow technological trends.

Let’s get into specifics. One metric I always look at is the price-to-sales ratio (P/S). This tells you how much investors are willing to pay for each dollar of revenue that the company generates. A high P/S ratio can indicate that the stock is overvalued, while a low P/S ratio can indicate that it is undervalued. But, and this is important, you need to compare the company’s P/S ratio to that of its competitors. Another metric to consider is the company’s growth rate. Is the company growing faster than its peers? If so, that could justify a higher valuation. But, ultimately, a comprehensive Zscaler stock forecast requires a deep dive into the company’s financial health and future growth.

Potential Risks and Opportunities for ZS Stock Investors

No investment is without risk, and ZS stock is no exception. One of the biggest risks is competition. As I mentioned earlier, the cybersecurity market is crowded, and Zscaler faces stiff competition from established players like CrowdStrike and Palo Alto Networks. These companies have deep pockets and are constantly innovating. Zscaler needs to stay ahead of the curve in order to maintain its market share. Another risk is the potential for economic downturn. If the economy slows down, businesses may cut back on their cybersecurity spending, which could hurt Zscaler’s revenue.

But, on the other hand, there are also significant opportunities for Zscaler. The demand for cybersecurity solutions is only going to increase in the years to come, as more and more businesses move their operations online. This trend is being driven by the rise of cloud computing, the Internet of Things (IoT), and the increasing sophistication of cyberattacks. Zscaler is well-positioned to benefit from this trend, as it has a proven track record and a comprehensive suite of security solutions. And, don’t forget the potential for acquisitions. Zscaler could acquire smaller companies in order to expand its product offerings and reach new markets. Investing in ZS stock is not just about cybersecurity; it is also about betting on technological innovation and market leadership.

ZS Stock | Is It Right for Your Portfolio?

So, after all this analysis, the big question remains: is ZS stock a good investment for you? That’s a question that only you can answer. But hopefully, this article has given you the information you need to make an informed decision. Remember to consider your own risk tolerance, investment goals, and time horizon. If you’re a conservative investor who is looking for stable, predictable returns, ZS stock may not be the best fit. But if you’re a more aggressive investor who is willing to take on some risk in exchange for the potential for higher returns, ZS stock could be worth considering. But what I find truly fascinating is the potential for long-term growth.

Ultimately, the decision of whether or not to invest in ZS stock is a personal one. Do your research, understand the risks and opportunities, and make a decision that is right for you. And remember, the stock market is a rollercoaster, so be prepared for some ups and downs along the way.

FAQ About ZS Stock

What does Zscaler actually do?

Zscaler provides cloud-based cybersecurity solutions to businesses, protecting them from threats like malware and data breaches.

Is ZS stock considered a growth stock?

Yes, ZS stock is generally considered a growth stock due to its potential for high revenue and earnings growth.

What are some alternative investments in the cybersecurity sector?

Alternative investments include CrowdStrike (CRWD) and Palo Alto Networks (PANW), both major players in the cybersecurity industry.

What if I’m new to investing in stocks?

If you’re new to investing, it’s best to consult with a financial advisor before making any decisions.

How can I stay updated on ZS stock news?

You can stay updated by following financial news websites and setting up alerts for ZS stock on your brokerage platform.