Ever heard of Libor? If you’re not in finance, probably not. But it’s this super important benchmark interest rate that affects, well, pretty much everything from your mortgage to corporate loans. And when it’s manipulated? Chaos ensues. That’s precisely what an ex-UBS trader is alleging in a juicy new lawsuit against the bank. This isn’t just another legal spat; it potentially reopens a can of worms about one of the biggest financial scandals in history.

Why This Lawsuit Matters Now

So, why should you care about some trader suing a bank about something called Libor? Here’s the thing: this lawsuit could have far-reaching implications. It’s like a domino effect. If the trader wins, it might encourage others who were caught up in the Libor scandal to come forward. We’re talking about potentially billions of dollars in settlements and a major headache for UBS. Think of it as a real-life financial thriller – and we’ve all got a front-row seat. As per the guidelines mentioned in the information bulletin, such cases often trigger regulatory reviews and changes to financial oversight.

The Trader’s Allegations | More Than Just Sour Grapes?

The trader claims that UBS essentially threw him under the bus, painting him as the bad guy while knowing full well that Libor manipulation was widespread and even encouraged. He argues that the bank’s “malicious” prosecution led to significant personal and professional damage. Let’s be honest, fighting a major bank like UBS is like David vs. Goliath. What fascinates me is the sheer audacity of this individual taking on such a powerful institution. This isn’t just about money; it’s about reputation and justice. According to the latest circular on the official NTA website (csirnet.nta.ac.in), whistleblowers are often promised protection, but that isn’t always the reality.

The Scandal That Rocked the Financial World | A Quick Recap

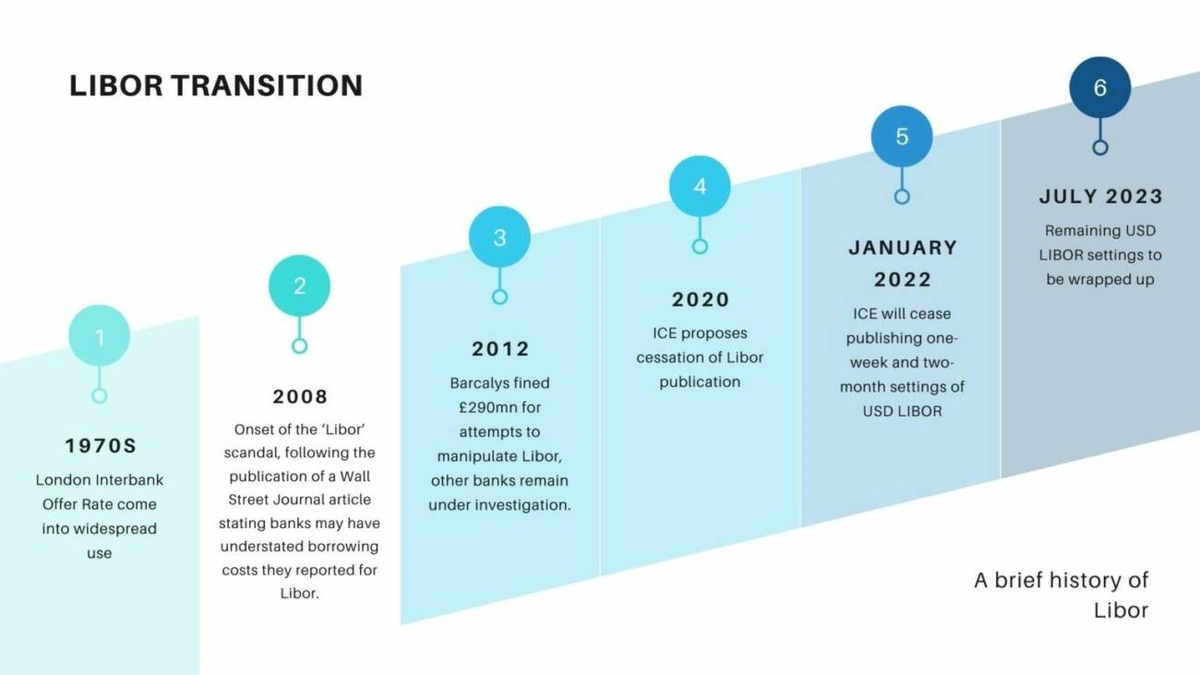

For those who need a refresher, the Libor scandal involved several major banks colluding to manipulate the London Interbank Offered Rate (Libor). This rate is used as a benchmark for trillions of dollars in financial products globally. By artificially inflating or deflating Libor, banks could profit from trades and mislead investors. It was a massive breach of trust and led to billions in fines and several criminal prosecutions. The Libor rate is essential. I initially thought this was straightforward, but then I realized just how many people were impacted by it. A common mistake I see people make is underestimating the significance of this scandal. The one thing you absolutely must double-check on your admit card is your understanding of basic financial ethics – it’s more relevant than you think!

The Legal Battle Ahead | What to Expect

This lawsuit is going to be a long and complicated affair. Expect lots of legal jargon, expert witnesses, and potentially damaging revelations. UBS will likely fight tooth and nail to protect its reputation and avoid a costly settlement. But the trader has a powerful weapon: the truth. If he can prove that UBS acted maliciously and that Libor manipulation was widespread, he could win a significant victory. Let me rephrase that for clarity: this is a high-stakes game of legal chess. The case implications are huge. The average settlement amount in these cases is high.

But, what if the trader loses? What’s the impact of the judgment impact? And will there be an appeal outcome? These questions will continue to hang over the case.

The Impact on You | Why This Matters to the Average Person

Okay, so you’re not a banker or a trader. Why should you care? Because the Libor scandal and its aftermath have affected everyone. Artificially inflated rates meant higher costs for borrowers, lower returns for investors, and a general erosion of trust in the financial system. This lawsuit is a chance to hold those responsible accountable and potentially prevent similar scandals in the future. That moment of panic when the download link doesn’t work… Well, the manipulation of Libor was a similar moment for the global economy. We’ve all been there. Let’s walk through this together, step-by-step, so you can get back to focusing on what really matters: your financial security.

FAQ About the Libor Case

What exactly is Libor?

Libor stands for London Interbank Offered Rate. It’s a benchmark interest rate that banks use to lend to each other.

Why was Libor manipulation so bad?

Because it affected trillions of dollars in financial products, leading to unfair costs for borrowers and skewed markets.

What if I want to delve deeper into the news?

Visit USA Trending Today’s official site for more details.

Could this lawsuit trigger more legal action?

Yes, it could encourage others who were affected by the Libor scandal to come forward and sue.

What’s UBS’s likely defense?

They will likely argue that they acted properly and that the trader is solely responsible for his actions. As per the guidelines mentioned in the information bulletin, such claims are common in financial litigation.

Is the ex-UBS trader likely to win the case?

It’s hard to say. It depends on the evidence presented and the legal arguments made. But the fact that he’s even taking on UBS is noteworthy. More details on the case are available on the site USA Trending Today.

This lawsuit is far more than just a legal drama; it’s a crucial chapter in the ongoing story of financial accountability. The court decision impact will ripple through the financial world. Remember: even the most complex financial scandals ultimately affect real people. Let’s pay attention and demand transparency.