Alright, let’s dive into ACA Open Enrollment . It might sound like bureaucratic jargon, but honestly? It’s your yearly chance to snag or update your health insurance through the Affordable Care Act (ACA), also known as Obamacare. And trust me, as someone who’s navigated the maze of healthcare options more times than I’d like to admit, this is something you don’t want to snooze on.

Why ACA Open Enrollment Matters

So, why should you care about ACA Open Enrollment? Well, here’s the thing: life happens. And when it does, having solid health insurance can be the difference between a manageable bump in the road and a financial catastrophe. We are talking about unexpected illnesses or accidents that can pop up without warning. The ACA was designed to make healthcare more accessible, especially for those who might not get it through their employer. Think of it as a safety net a crucial one.

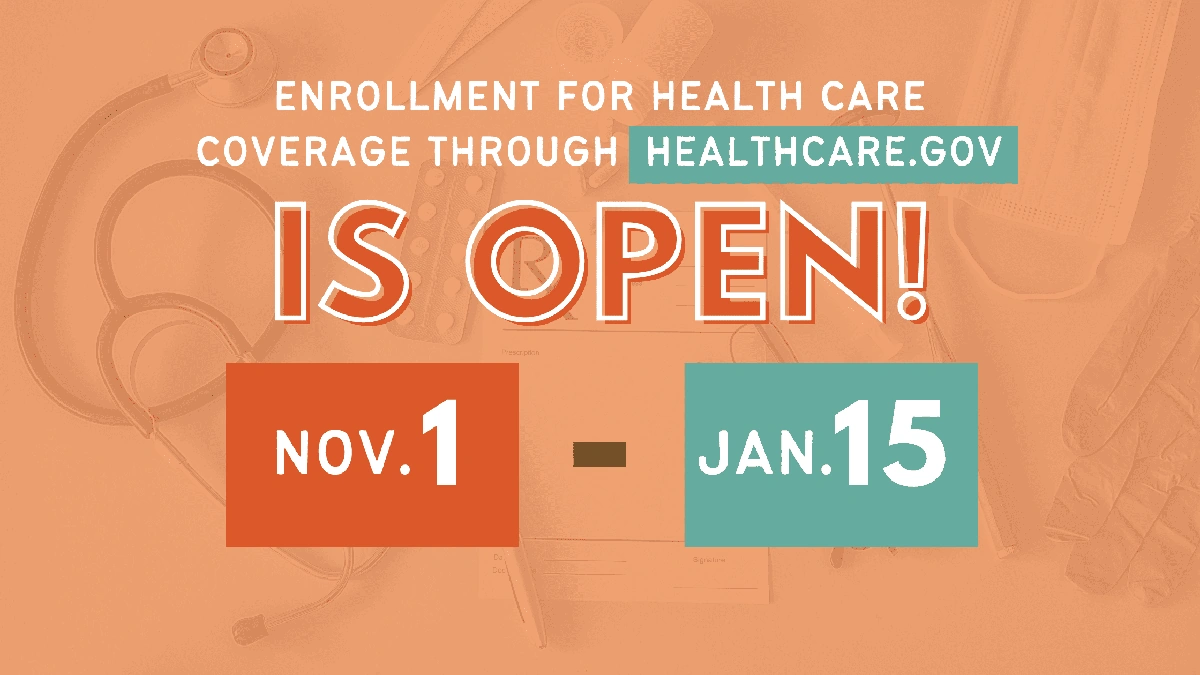

The Affordable Care Act marketplace is where you can compare plans, see if you qualify for subsidies (financial assistance), and enroll. According to the official Healthcare.gov website, open enrollment typically runs from November 1st to January 15th in most states. Miss that window, and you usually have to wait until the next open enrollment period unless you have a qualifying life event (like getting married, having a baby, or losing your job).

But let’s be honest, the whole thing can be a bit overwhelming. I initially thought it was pretty straightforward, but then I realized just how many options and nuances there are. So, let me break it down. Think of me as your friendly neighborhood guide through the healthcare jungle.

Navigating the Enrollment Process | A Step-by-Step Guide

Okay, let’s get practical. How do you actually enroll? It’s not as scary as it seems, I promise. Here’s a step-by-step breakdown:

- Gather Your Documents: Before you even start, collect all the necessary documents. This includes your social security number, income information (like pay stubs or W-2 forms), and policy numbers for any current health insurance you might have.

- Visit Healthcare.gov: Head over to the official website. It’s the central hub for all things ACA. You can also access the marketplace through your state’s website if it has its own exchange.

- Create an Account or Log In: If you’re new to the marketplace, you’ll need to create an account. If you’ve enrolled before, just log in.

- Complete the Application: This is where you provide all the details about your household, income, and healthcare needs. Be as accurate as possible – your information will be used to determine your eligibility for subsidies.

- Compare Plans: Once your application is processed, you’ll see a list of available plans in your area. Take your time to compare them. Look at the premiums (monthly payments), deductibles (what you pay before insurance kicks in), copays (fixed amounts you pay for services), and the network of doctors and hospitals.

- Choose a Plan: Pick the plan that best fits your needs and budget.

- Enroll: Follow the prompts to complete your enrollment. You’ll typically need to confirm your information and make your first payment.

A common mistake I see people make is rushing through the application. Double-check everything! A small error could impact your eligibility for financial assistance.

Understanding the Different Types of Plans

Now, let’s talk about the different types of plans. You’ll generally see plans categorized as Bronze, Silver, Gold, and Platinum. Each metal level represents the degree to which the plan shares costs with you. Bronze plans have the lowest premiums but the highest out-of-pocket costs, while Platinum plans have the highest premiums and the lowest out-of-pocket costs. Silver plans are popular because they provide cost-sharing reductions for those who qualify, meaning lower deductibles and copays.

HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) are two common types of managed care plans. An HMO plan typically requires you to choose a primary care physician (PCP) who coordinates your care and refers you to specialists. PPO plans usually offer more flexibility to see specialists without a referral, but they may have higher out-of-pocket costs. So, choose wisely! The best health insurance choice is a personal one, depending on your health status.

Maximizing Your Savings

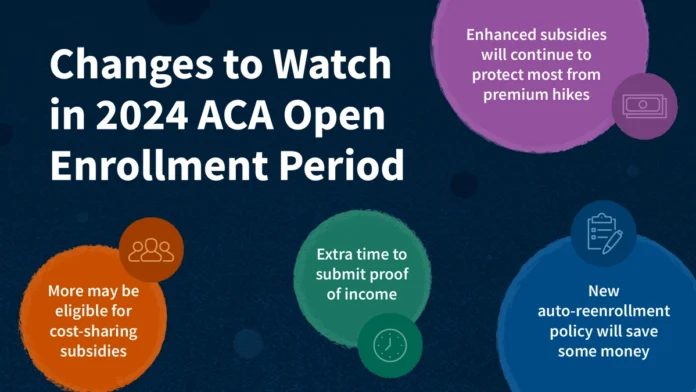

One of the biggest benefits of the ACA is the availability of subsidies. These subsidies come in two forms: premium tax credits and cost-sharing reductions. Premium tax credits help lower your monthly premiums, while cost-sharing reductions help lower your out-of-pocket costs, such as deductibles and copays. According to the Kaiser Family Foundation , eligibility for these subsidies is based on your income and household size.

Here’s a pro tip: Don’t just assume you don’t qualify. Even if you’ve been denied in the past, it’s worth checking again. Income thresholds change, and your situation might be different this year. To estimate your potential savings, use the ACA subsidy calculator available on the Healthcare.gov website.

Addressing Common Concerns and Misconceptions

Let’s be honest; the ACA has its fair share of critics, and there are plenty of misconceptions floating around. One common concern is the cost. Yes, premiums can be high, especially if you don’t qualify for subsidies. Another concern is limited choices. In some areas, the number of insurers participating in the ACA marketplace is limited, which can reduce competition and drive up prices. For that reason, consider enlisting the help of a health insurance broker.

But what fascinates me is how often people focus on the downsides without considering the alternative. Before the ACA, millions of Americans were uninsured and one serious illness away from bankruptcy. The ACA isn’t perfect, but it has made a significant difference in expanding access to healthcare.

FAQ About ACA Open Enrollment

Frequently Asked Questions

What if I miss the open enrollment deadline?

Generally, you can only enroll in a health insurance plan outside of the open enrollment period if you qualify for a special enrollment period. This is triggered by a qualifying life event, like losing coverage from a job, getting married, or having a baby.

How do I know if I qualify for a subsidy?

Your eligibility for a subsidy is based on your income and household size. The Healthcare.gov website has tools to help you estimate your potential savings.

Can I change my plan after open enrollment ends?

Typically, you can only change your plan outside of open enrollment if you have a qualifying life event.

What happens if I don’t enroll in a plan?

While there’s no longer a federal tax penalty for not having health insurance, going without coverage can be risky. You’ll be responsible for the full cost of any medical care you receive, which can be substantial.

In conclusion, ACA Open Enrollment is a critical opportunity to secure health insurance coverage that protects your health and financial well-being. Don’t let the jargon intimidate you. Take the time to understand your options, explore potential subsidies, and choose a plan that fits your needs. Your future self will thank you.