Alright, let’s talk about something that’s probably affecting your wallet, your job, and maybe even your mood: consumer sentiment . Here’s the thing – it’s tanking. Like, hitting-the-bottom-of-the-barrel kind of tanking. But before you start panic-buying instant noodles, let’s unpack what this actually means, especially for us here in India.

Why Should You Care About Consumer Sentiment?

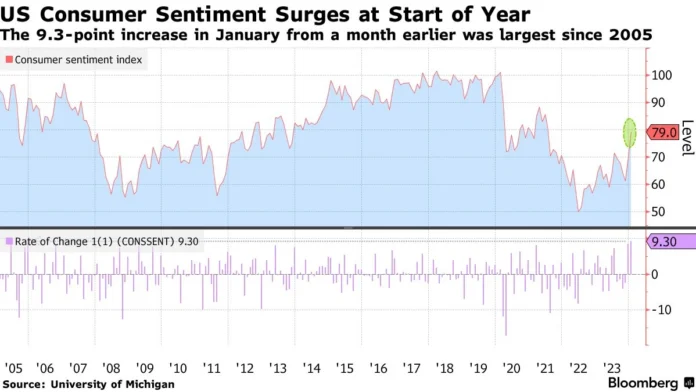

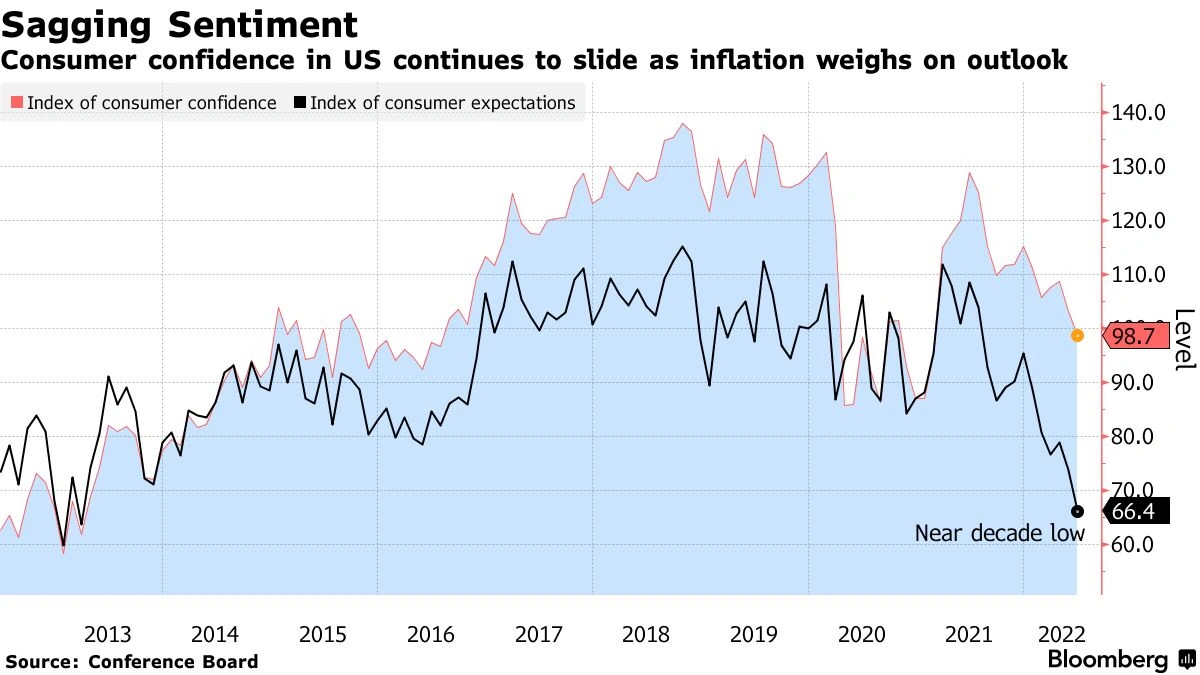

So, what is consumer sentiment index , and why should anyone even bother paying attention? Well, it’s basically a snapshot of how optimistic or pessimistic people feel about the economy. Are they confident enough to splurge on that new phone or that vacation they’ve been eyeing, or are they tightening their belts and saving every rupee they can? This collective feeling can actually predict future economic trends. If people are feeling down, they spend less, businesses suffer, and… you get the picture. It’s a bit like a self-fulfilling prophecy, honestly.

But the thing that is really mind-boggling is how it all ties together to create a big economic landscape. From jobs to the stock market, consumer sentiment acts as a barometer of the overall health of an economy. If it rises, it shows there is confidence. If it falls, it shows the economy is at risk.

The Indian Context | More Than Just Numbers

Now, let’s zoom in on India. Our economic landscape is unique, right? We’ve got a massive population, a diverse range of industries, and a whole lot of cultural nuances that affect how we spend our money. So, a dip in consumer confidence isn’t just a number; it’s a reflection of real-world anxieties.

Maybe it’s the rising fuel prices pinching our pockets. Maybe it’s worries about job security in a rapidly changing tech landscape. Or maybe it’s just the general feeling of uncertainty in the world right now. Whatever the reason, understanding these anxieties is crucial for businesses and policymakers alike.

Decoding the Dip | What’s Really Going On?

Okay, so the sentiment is down. But why? Let’s put on our detective hats and dig a little deeper. I initially thought it was solely about inflation, but then I realized there are several layers to this onion. Factors to consider include:

- Inflationary Pressures: The prices of everyday essentials are soaring. This leads to an increased cost of living, leaving less disposable income in the hands of the average consumer.

- Geopolitical Instability: Global events are causing ripples in our economy.

- Uncertainty: The fear of the unknown can have a significant impact on spending habits.

And as per the data available on Trading Economics , the India consumer confidence is still low. The numbers are not that promising as compared to the previous years. This is not great for an emerging market like ours.

How Does This Affect You? Practical Steps to Take

Alright, enough doom and gloom. Let’s talk about what you can actually do about this. Because let’s be honest, feeling helpless isn’t exactly a recipe for a good mood. Here’s how to navigate these uncertain times:

- Re-evaluate your budget: Take a hard look at your expenses and see where you can trim the fat. Do you really need that daily latte?

- Invest wisely: Don’t put all your eggs in one basket. Diversify your investments and consider consulting with a financial advisor.

- Upskill: The job market is constantly evolving. Invest in your skills and knowledge to stay relevant. The one thing you absolutely must double-check is to find jobs that are evergreen and stay away from the hype!

Remember, knowledge is power. The more you understand about the economy and your own finances, the better equipped you’ll be to weather any storm. Consumer sentiment, economic downturn , and whatever curveballs the future throws at us!

Also do check out the blogs on Trending Topics .

The Silver Lining | Opportunities in Times of Uncertainty

Okay, so things might seem a bit bleak right now. But here’s the thing: every crisis also presents opportunities. When everyone else is panicking, smart investors are finding undervalued assets. When companies are cutting costs, entrepreneurs are finding innovative ways to disrupt the market.

Maybe this is the time to start that side hustle you’ve always dreamed of. Maybe it’s the time to invest in a skill that’s in high demand. Or maybe it’s simply the time to re-evaluate your priorities and focus on what truly matters to you. According to the latest circular on the official NITI Aayog website, India’s focus on self-reliance and innovation will create numerous entrepreneurial opportunities in the long run.

FAQ

Frequently Asked Questions

What exactly is “consumer sentiment,” anyway?

It’s basically a measure of how optimistic or pessimistic people are about the economy. It’s based on surveys that ask people about their financial situation and their expectations for the future.

How is consumer spending affected by low sentiments?

People tend to spend less when they’re worried about the economy. This can lead to a slowdown in economic growth.

Where can I find reliable data on consumer sentiment in India?

Check out reports from the Reserve Bank of India (RBI) and surveys conducted by reputable research organizations.

What if I’m feeling overwhelmed by all this economic news?

Take a break! It’s important to stay informed, but don’t let it consume you. Focus on what you can control and take care of your mental health.

Consumer Sentiment is always evolving, especially with the emergence of new technologies and changing demographics. Staying informed and adapting to these shifts is crucial for navigating the economy effectively. It’s not just about surviving; it’s about thriving, even in uncertain times.