Okay, let’s dive into the world of Alphabet stock price . But not in a boring, number-crunching way. Here’s the thing: stock prices aren’t just random figures. They tell a story – a story about a company’s health, its future, and even the broader economic landscape. What fascinates me is how much you can learn by understanding the ‘why’ behind those fluctuating digits. We aren’t just looking at a ticker symbol; we’re analyzing the heart of a tech giant.

Why Alphabet’s Stock Matters (Beyond Your Portfolio)

Sure, if you own Alphabet stock (GOOGL), you’re probably checking the price daily. But even if you don’t, it’s worth paying attention. Why? Because Alphabet, the parent company of Google, YouTube, and a whole host of other ventures, is a bellwether for the entire tech industry. Its performance often signals broader trends. When Alphabet’s market capitalization shifts significantly, it can impact everything from investor confidence to the valuation of other tech companies. And that, my friends, trickles down to everyone.

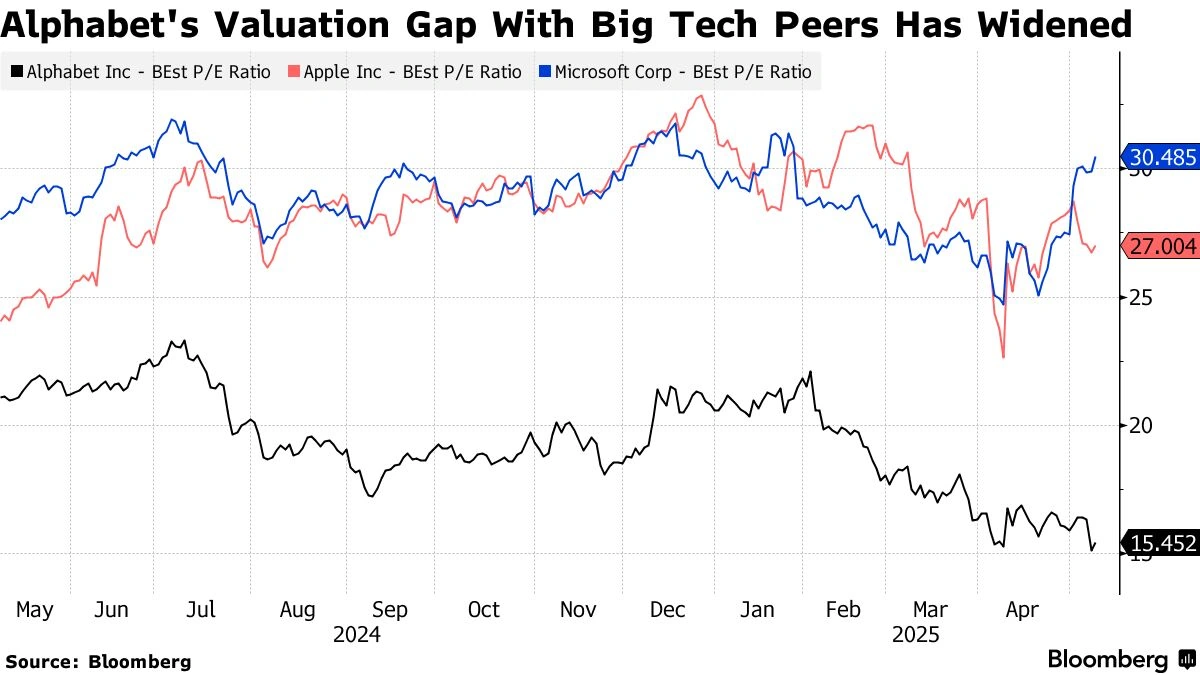

Think of it this way: Alphabet is like the captain of a giant ship. Where it steers, others tend to follow. A strong Alphabet stock forecast can mean innovation is thriving, advertising revenue is flowing, and the economy, at least in the tech sector, is chugging along nicely. A weak performance? Well, that might suggest headwinds. It might mean competition is heating up, regulatory pressures are increasing, or that the company’s facing some internal challenges.

Reading the Tea Leaves | Factors Influencing the Price

What makes the GOOGL stock forecast move up or down? It’s a complex interplay of factors. Let’s break down a few key ones:

- Earnings Reports: This is the big one. Every quarter, Alphabet releases its financial results. Did they beat expectations? Did they miss? Analysts dissect these reports like detectives at a crime scene. Revenue growth, profit margins, and user engagement are all scrutinized.

- New Product Launches: Did Google just unveil a groundbreaking new AI model? Did YouTube announce a game-changing feature for creators? Innovation excites investors, and excitement translates to higher stock prices.

- Regulatory Scrutiny: Here’s where things get tricky. Alphabet, being a massive company, often finds itself in the crosshairs of regulators. Antitrust lawsuits, privacy concerns, and tax disputes can all weigh heavily on the stock.

- Broader Economic Trends: Inflation, interest rates, and global economic growth all have an impact. In a recession, for example, companies tend to cut back on advertising spending, which directly affects Google’s bottom line.

- Investor Sentiment: Sometimes, the market just feels optimistic or pessimistic. This can lead to irrational exuberance or panic selling, regardless of the underlying fundamentals.

Understanding these factors isn’t about predicting the future (nobody can do that consistently!). It’s about having a framework for understanding why the stock is moving the way it is. And that, in turn, helps you make more informed decisions. Remember, it is important to note Alphabet’s dividend policy and how it could influence your investment decision.

How to Track Alphabet Stock Price (Without Losing Your Mind)

Okay, so you’re intrigued. You want to keep an eye on GOOGL stock , but you don’t want to become a day-trading zombie glued to your screen 24/7. I get it. Here’s a sane approach:

- Choose Your Sources Wisely: Stick to reputable financial news outlets like The Wall Street Journal, Bloomberg, or Reuters. The Wall Street Journal is a solid source. Avoid random blogs or social media hype.

- Set Realistic Expectations: Stock prices fluctuate. It’s normal. Don’t panic sell at the first sign of a dip. Think long-term.

- Understand Your Risk Tolerance: Are you a conservative investor or a risk-taker? This will determine how much of your portfolio you allocate to a volatile stock like Alphabet.

- Use a Brokerage Account: You’ll need a brokerage account to buy and sell stock. There are tons of options out there, from traditional brokers to online platforms like Robinhood or Fidelity.

- Consider Dollar-Cost Averaging: Instead of trying to time the market, invest a fixed amount of money in Alphabet stock at regular intervals. This helps smooth out the volatility.

Also, keep tabs on the nasdaq composite , as it gives a general idea of how the market is performing.

The Future of Alphabet | Bets and Beyond

Alphabet isn’t just Google. It’s a collection of “Other Bets” – ambitious, often experimental projects ranging from self-driving cars (Waymo) to life sciences (Calico). These “Other Bets” are like moonshots. Some will fail, but others could be massive successes that drive the next wave of growth. Keep tabs on the evolution of Alphabet’s business segments to better understand where the company is headed.

What I’m personally excited about is Alphabet’s continued investment in artificial intelligence. AI is transforming everything, and Google is at the forefront. From search algorithms to cloud computing, AI is woven into the fabric of Alphabet’s business. And that, I believe, is a key reason to be optimistic about its long-term prospects. In conclusion, the analysis of Alphabet’s financial performance is best left to the experts.

Check out Nestle CEO Laurent Freixe for more business insights.

Check out first energy bill for more information.

FAQ | Your Burning Questions About Alphabet Stock

What’s the ticker symbol for Alphabet stock?

Alphabet has two ticker symbols: GOOGL (for Class A shares) and GOOG (for Class C shares). The Class A shares have voting rights, while the Class C shares don’t.

Is Alphabet stock a good investment?

That depends on your individual circumstances and risk tolerance. Do your research, consult with a financial advisor, and make an informed decision.

How often does Alphabet pay dividends?

As of now, Alphabet does not pay dividends.

Where can I find the latest Alphabet stock news?

Reputable financial news websites and brokerage platforms are your best bet.

What are some of Alphabet’s main competitors?

Microsoft, Amazon, Apple, and Facebook (Meta) are among Alphabet’s biggest rivals.

What’s the difference between GOOGL and GOOG stock?

GOOGL shares have voting rights, while GOOG shares do not. This difference can sometimes affect the stock price slightly.