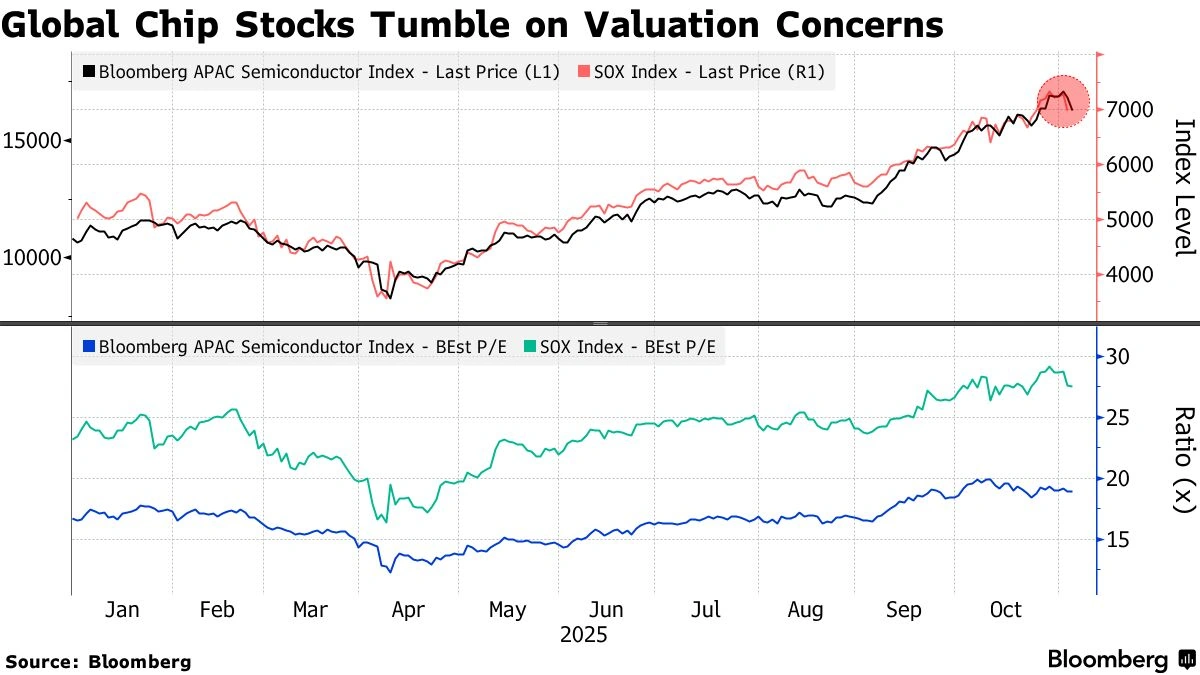

Okay, so you’ve probably seen the headlines: chip stocks are getting hammered. We’re talking about half a trillion dollars vanishing into thin air. Sounds scary, right? But before you start panicking and selling off your investments, let’s take a breath and figure out what’s really going on. This isn’t just about numbers; it’s about understanding the forces shaping the future of technology and, frankly, the global economy.

The “Why” | Decoding the Chip Stock Bloodbath

Here’s the thing: chip stocks are often a bellwether for the broader tech sector. They’re the essential components in everything from your smartphone to your car. When chip stocks start tanking, it usually signals trouble brewing in the overall demand for tech gadgets and electronics. But why is this happening now?

A big part of it boils down to fears of a global economic slowdown. Remember all the pent-up demand during the pandemic when everyone was buying new laptops and gaming consoles? Well, that surge is now fading. Inflation is biting into people’s disposable income, and consumers are becoming more cautious about spending on non-essential items. “ This has had a major impact on semiconductor demand .”

And then there’s the geopolitical angle. Tensions between the US and China are casting a long shadow over the chip industry. The US government has been imposing restrictions on chip exports to China, aiming to curb China’s technological advancement. This is creating uncertainty for chipmakers who rely heavily on the Chinese market. I initially thought this was straightforward, but then I realized – it’s much more nuanced than just a simple supply and demand issue.

Digging Deeper | Supply Chain Woes and Inflation

The global supply chain mess, which became so notorious during the pandemic, is still causing ripples. While the situation has improved somewhat, lead times for certain chips remain elevated. This means that companies are struggling to get the chips they need to manufacture their products, which in turn is impacting their revenue and profitability. So, what’s the solution?

Inflation also plays a significant role. The rising cost of raw materials, energy, and labor is putting pressure on chipmakers’ margins. To maintain profitability, they’re forced to raise prices, which further dampens demand. It’s a vicious cycle. Let’s be honest, navigating these economic waters is tough for everyone.

Investing in Chip Stocks | Is Now the Time to Panic?

Okay, so the market is down. But a correction isn’t always the end of the world. Here’s why – market corrections are a normal part of the investment cycle. They offer opportunities for savvy investors to buy quality stocks at discounted prices. So, is now the time to buy semiconductor stocks ?

Well, it depends on your risk tolerance and investment horizon. If you’re a long-term investor, this could be a good opportunity to accumulate shares in solid chip companies with strong fundamentals. But be prepared for volatility. The chip market may not recover overnight. A common mistake I see people make is panic-selling during market downturns. It’s often better to ride out the storm and focus on the long-term potential.

Future Trends | What’s Next for the Chip Industry?

Despite the current challenges, the long-term outlook for the chip industry remains bright. The demand for chips is only going to increase as technologies like artificial intelligence, 5G, and the Internet of Things become more prevalent. The one thing you absolutely must double-check is your investment strategy. Is it aligned with your financial goals and risk tolerance?

The rise of the metaverse will further fuel the need for powerful chips to power virtual and augmented reality experiences. And as electric vehicles become more mainstream, the demand for automotive chips will skyrocket. So, while there may be short-term headwinds, the chip industry is poised for long-term growth.

Furthermore, government initiatives to bolster domestic chip manufacturing are underway in various countries, including the US and India. These initiatives aim to reduce reliance on foreign suppliers and enhance national security. This could create new opportunities for chip companies and investors alike. The global economy is changing rapidly, and the chip industry is at the heart of this transformation. Click here for more information.

The India Angle | A Nascent Chip Manufacturing Hub

India is making a concerted effort to become a major player in the global semiconductor industry . The government is offering attractive incentives to companies that set up chip manufacturing facilities in India. This could create a significant number of jobs and boost the country’s economy. I initially thought this was straightforward, but then I realized the geopolitical implications are huge. Wikipedia’s Semiconductor Page

The potential benefits for India are enormous. Not only would it reduce the country’s reliance on chip imports, but it would also position India as a key player in the global technology landscape. The Indian government is actively promoting the “Make in India” initiative in the semiconductor sector, aiming to attract investments and create a vibrant ecosystem for chip design and manufacturing. According to the latest reports, several major chip companies are considering setting up operations in India. The country’s large pool of skilled engineers and its growing domestic market make it an attractive destination for chipmakers.

FAQ About the Chip Selloff

Frequently Asked Questions

What caused the chip selloff?

Fears of a global economic slowdown, inflation, and geopolitical tensions have contributed to the chip selloff.

Is this a good time to invest in chip stocks?

It depends on your risk tolerance and investment horizon. Long-term investors may find this a good opportunity to buy quality stocks at discounted prices.

What are the long-term prospects for the chip industry?

The long-term outlook for the chip industry remains bright, driven by growing demand for technologies like AI, 5G, and IoT.

How is India positioning itself in the chip industry?

India is making a concerted effort to become a major player in the global semiconductor industry, offering incentives to attract chip manufacturing facilities.

What are some related keywords to consider when researching this topic?

Some related keywords include: semiconductor stocks, chip market, global economy, supply chain, semiconductor industry, global chip shortage, investment strategies.

What is the role of the metaverse in the future of the chip industry?

The rise of the metaverse will further fuel the need for powerful chips to power virtual and augmented reality experiences, driving demand for advanced semiconductor technologies.

So, there you have it. The chip selloff is a complex issue with multiple contributing factors. While there may be short-term pain, the long-term outlook for the chip industry remains promising, particularly with India’s growing role in the global landscape. The situation requires a nuanced understanding of economic trends, geopolitical factors, and technological advancements. Navigating these market conditions requires careful consideration and a well-informed investment strategy. Don’t panic – stay informed, stay diversified, and stay focused on the long term. Read more.