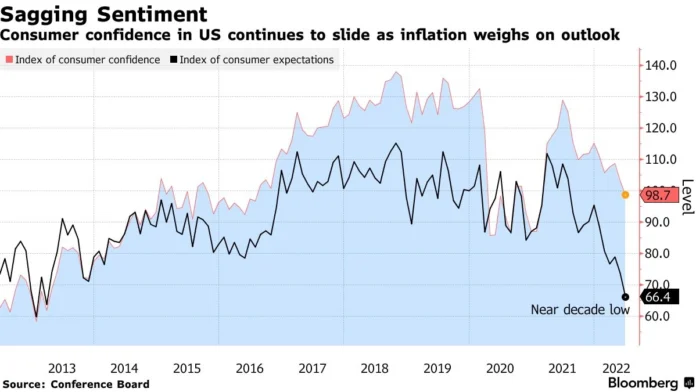

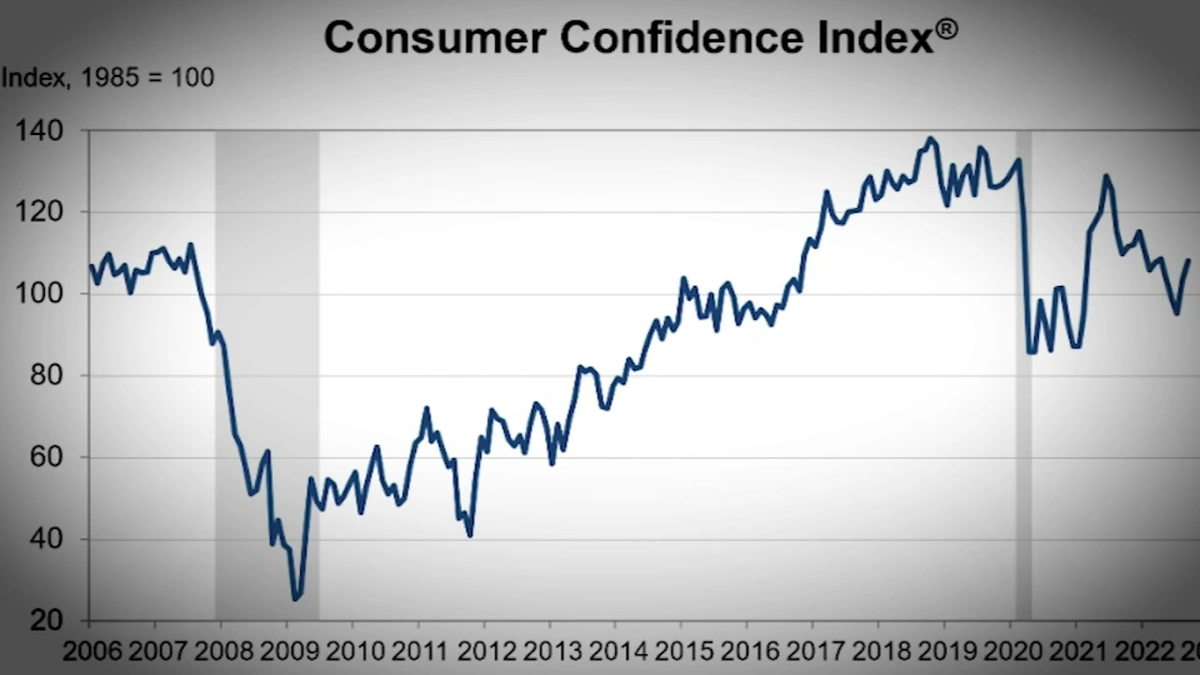

Okay, folks, let’s talk about something that’s probably already stressing you out: money. Or, more accurately, the collective feeling about money, which, according to the latest University of Michigan survey, is circling the drain. Consumer Confidence , that nebulous yet powerful force that drives our spending habits, has taken a nosedive, hitting levels close to the all-time lows we saw during, well, you know… gestures vaguely at the dumpster fire that was 2008.

Why Should You Care? (Spoiler | It’s Not Just About Rich People)

Here’s the thing: you might be thinking, “So what? I’m not a Wall Street tycoon.” But consumer sentiment impacts everyone. When people feel good about the economy, they spend more. They buy that new scooter, eat out more often, and maybe even take that long-delayed trip. This spending fuels businesses, creates jobs, and generally keeps the wheels turning. But when confidence tanks? People clutch their wallets tighter than a miser guarding his gold, and the whole shebang slows down.

Think of it like this: imagine a bunch of dominoes lined up. Consumer confidence is the first domino. When it falls, the rest tend to follow.

Digging Deeper | What’s Behind the Slump?

So, what’s causing this collective case of the financial blues? Well, a few things. Inflation, for one. Everything costs more these days, and wages haven’t exactly kept pace. We are seeing increasing economic uncertainty too. Then there’s the ongoing geopolitical instability – wars, conflicts, and general global chaos. And let’s not forget the lingering effects of the pandemic, which has thrown a giant wrench into supply chains and labor markets. The average Indian household is particularly feeling the pinch as staples become more expensive.

But, and this is a big but, there’s also a psychological element at play. We’re constantly bombarded with negative news, doom-and-gloom headlines, and social media posts highlighting all the bad stuff happening in the world. It’s enough to make anyone want to crawl under a rock and wait for it all to blow over. According to the U of Michigan survey,inflation expectationsremain stubbornly high, which further erodes consumer confidence.

The Indian Perspective | A Layered Cake of Concerns

Now, let’s zoom in on India. While the global factors certainly play a role, we have our own unique set of concerns. The strength of the monsoon season, for instance, directly impacts agricultural output and food prices. Political stability, or lack thereof, can spook investors and businesses. And let’s not forget the ever-present issue of unemployment, which disproportionately affects young people.

What fascinates me is how resilient the average Indian consumer is. Despite all the challenges, there’s a certain optimism that persists. But even the most resilient among us have our breaking points. And if declining consumer confidence continues, it could put a serious damper on India’s economic growth story.

What Can You Do About It? (Besides Panic Buying Toilet Paper)

Okay, so we’ve established that consumer confidence is down, and that’s not great. But what can you, as an individual, do about it? Well, probably not much to single-handedly reverse the trend, but you can take steps to protect yourself and your family.

Here’s the thing: financial planning isn’t just for rich people. It’s for everyone. Start by creating a budget. Track your expenses, identify areas where you can cut back, and build an emergency fund. Even a small amount saved each month can make a big difference in the long run.

And remember, don’t let fear drive your decisions. Yes, the economy is uncertain, but that doesn’t mean you should stop investing altogether. Talk to a financial advisor, do your research, and make informed choices that align with your long-term goals. A common mistake I see people make is reacting emotionally to market fluctuations. Stay calm, stay informed, and stay the course.

Consider diversifying your income streams. Can you start a side hustle? Offer your skills as a freelancer? Even a small amount of extra income can provide a much-needed cushion during tough times. The one thing you absolutely must double-check is your financial plan is realistic and achievable. Check out some tips.

Looking Ahead | Can Confidence Rebound?

So, is there any hope for a rebound in consumer confidence? Absolutely. But it’s going to take a concerted effort from governments, businesses, and individuals. Governments need to implement policies that support economic growth, create jobs, and address inflation. Businesses need to invest in their employees, offer fair wages, and build trust with their customers. And individuals need to stay informed, make smart financial decisions, and support their local communities.

Ultimately, consumer confidence is a self-fulfilling prophecy. When we believe things will get better, we act in ways that make them better. And when we succumb to fear and negativity, we risk creating a downward spiral. So, let’s choose optimism. Let’s choose hope. And let’s choose to believe in the power of the indian economy .

Personal finances remain a key topic of interest.

FAQ

Will the stock market crash soon?

Predicting market crashes is impossible. Focus on long-term investing and diversification.

What if I lose my job?

Actively network, update your resume, and explore government assistance programs.

Is it a good time to buy a home?

Assess your personal financial situation and consider current interest rates. A mortgage is not a joke.

How can I reduce my debt?

Create a budget, prioritize high-interest debt, and explore debt consolidation options.

What is the impact of rising interest rates on my savings?

Rising interest rates can increase returns on some savings accounts, but also increase borrowing costs.

How do i improve my overall financial well-being?

Focus on financial education, budgeting, saving, and investing wisely.

The key takeaway? Consumer confidence is a fragile thing, but it’s not beyond repair. With a little bit of effort, a little bit of optimism, and a whole lot of common sense, we can turn the tide and create a brighter financial future for ourselves and for generations to come.