Okay, let’s be honest. When I saw “Dow Futures Jump,” my first thought wasn’t about complex economic strategy. It was, “How does this affect my chai budget this month?” Because let’s face it, in India, global markets often feel like a distant planet… until they hit your pocket. But this jump? This has some serious implications for us, and it’s all tied to Trump’s – or should I say, former President Trump’s – comments regarding the US-China trade relationship.

So, Dow futures are pointing upwards. Big deal, right? Well, it is a big deal. It’s not just numbers dancing on a screen; it’s a reflection of investor confidence, which, in turn, can trickle down to everything from the price of imported electronics to the strength of the rupee. But what exactly did Trump say that caused this ripple effect? And more importantly, should you start celebrating, or is this just another flash in the pan? That’s what we’re going to break down.

Why Trump’s Words Still Matter to Dow Futures

Here’s the thing: even out of office, Trump’s words carry weight, especially when it comes to China. His administration’s trade policies cast a long shadow, and any hint of easing tensions – or, conversely, escalating conflict – sends shivers down the spines of investors. Think of it like this: the market is a super-sensitive seismograph, and Trump’s comments are the earthquake. The magnitude of the quake? That depends on the specifics.

So, what were the specifics? Well, reports suggest Trump made some vaguely conciliatory remarks, hinting at the possibility of revisiting certain tariffs or trade restrictions imposed during his presidency. Now, let me rephrase that for clarity: It wasn’t a full-blown apology or reversal of policy, but more of a “maybe, possibly, under certain conditions…” kind of statement. But in the world of stock market futures , that’s often enough to spark a rally. Because hope, as they say, springs eternal (especially in the hearts of traders looking for a quick buck).

The thing is, the US-China trade relations are still fragile. We’ve seen how quickly things can escalate. Consider, for instance, how quickly a single tweet can impact the market. While this jump in Dow futures is encouraging, it’s crucial to remain cautious. It’s a reminder that global economies are interconnected, and events in one part of the world can have significant repercussions elsewhere.

Decoding the Market Reaction | More Than Just Headlines

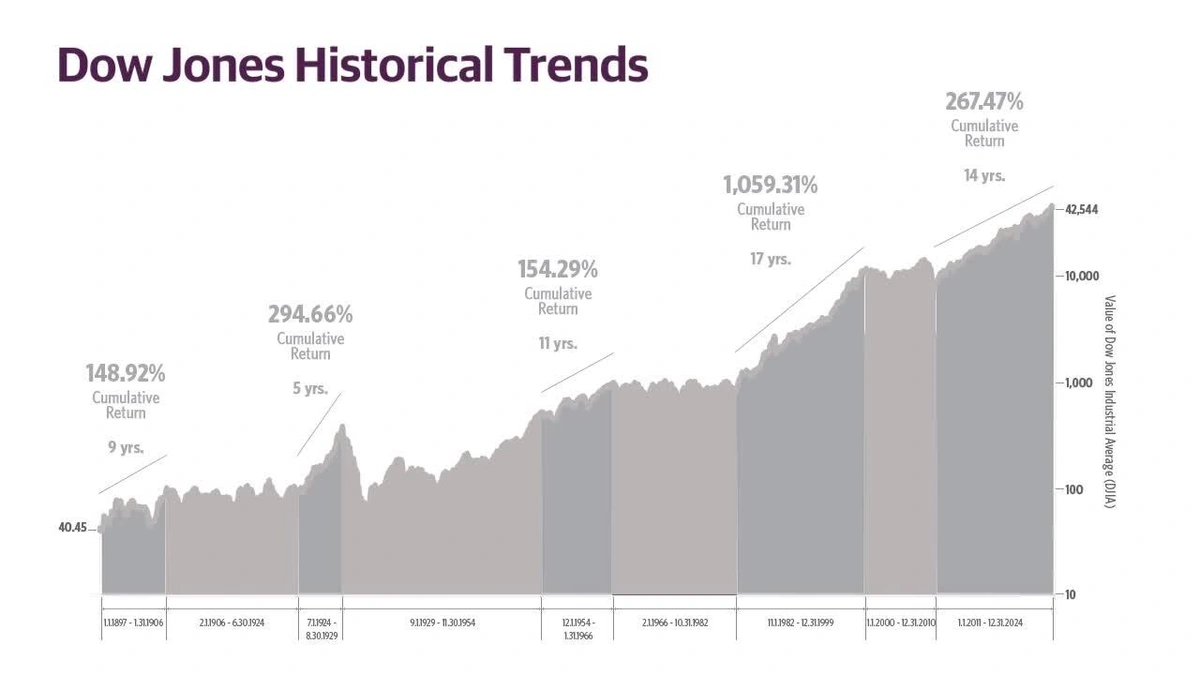

Okay, so the market reacted positively. But why? What’s the underlying logic? Well, first, consider the companies that make up the Dow Jones Industrial Average. Many of them are multinational corporations with significant exposure to China. A trade war hits their bottom line hard. So, any suggestion that those headwinds might ease is naturally good news for their stock prices.

But there’s more to it than just corporate profits. It’s also about stability. Uncertainty is the enemy of investment. Investors crave predictability. When trade relations are fraught with tension, it makes it difficult to plan for the future. A hint of détente, even a slight one, reduces that uncertainty and encourages investors to deploy capital. The global supply chainis intricately linked, and disruptions can lead to increased costs and delays, impacting businesses across various sectors.

Navigating the Volatility | What This Means for the Indian Investor

Now, for the million-dollar question: How does this affect you, the Indian investor? Well, indirectly, but significantly. A stronger global economy generally translates to increased demand for Indian goods and services. It can also lead to increased foreign investment in Indian markets. So, a rising tide lifts all boats, as they say.

But here’s the crucial caveat: volatility. Market volatility is inherent. The Dow Jones may jump today, but it could just as easily tumble tomorrow. This is not a get-rich-quick scheme. It’s a long-term game. The one thing you absolutely must remember is that short-term market fluctuations should not dictate your long-term investment strategy.

What fascinates me is how easily fear and greed can drive the market. It’s important not to get caught up in the hype and make rash decisions. Always do your research and consult with a financial advisor before making any investment decisions. The most important thing is to stay informed and make rational decisions based on your individual financial goals and risk tolerance. Remember the story of that one time when… oh never mind, it’s not important now.

Beyond Dow Futures | The Bigger Picture of Global Trade

The Dow futures’ reaction isn’t just about Trump or even about trade. It’s about the shifting global landscape. We are in a multipolar world now, and the relationship between the US and China is the most important geopolitical dynamic of our time. It will shape everything from technological innovation to military strategy. It is, therefore, crucial to keep an eye on the economic indicators to understand the broader trends.

And what is the takeaway from all this? The market is complex, and it moves based on so many factors. This jump in Dow futures is an interesting event, and it provides some opportunities for investors. But just be sure to do your research. I initially thought this was straightforward, but then I realized… It requires patience and a long-term perspective. Don’t let the daily headlines dictate your long-term financial well-being. Invest wisely, stay informed, and remember that a balanced portfolio is your best friend. A common mistake I see people make is to panic when the market dips. Instead, view it as an opportunity to buy quality stocks at a lower price.

FAQ | Your Burning Questions Answered

Frequently Asked Questions

What exactly are Dow futures?

They are contracts that allow investors to speculate on the future value of the Dow Jones Industrial Average. Think of it as betting on whether the Dow will go up or down.

Why do Trump’s comments still move the market?

His past policies created a lot of uncertainty, and any hint of change – even from a former president – can have an impact.

Is this a good time to invest in the US stock market?

It depends on your risk tolerance and investment goals. Consult with a financial advisor before making any decisions.

How can I stay informed about global market trends?

Follow reputable financial news sources, read analyst reports, and stay updated on geopolitical events.

What if I’m a beginner investor?

Start small, invest in diversified index funds, and learn as you go. Don’t put all your eggs in one basket!

Could this rally be a “dead cat bounce”?

Absolutely. That’s why caution and careful analysis are always paramount. Don’t jump to conclusions.

So, the Dow futures jumped. That’s the news. But the real story is the intricate dance between global politics, investor psychology, and your chai budget. Keep watching, keep learning, and keep your wits about you. Because in the world of finance, the only constant is change.