Alright, let’s be real. When the monthly jobs report drops, most people glaze over. Numbers, percentages it all feels like alphabet soup, right? But here’s the thing: those numbers? They’re telling a story. A story about whether you’re likely to get a raise, whether your neighbor might lose their job, and even whether that new restaurant you’ve been eyeing will survive. What fascinates me is how deeply this report impacts our everyday lives.

We’re not just going to regurgitate the headlines. We’re diving deep into the ‘why’ behind the numbers. Why this happened and what it signals about the economy, your job security, and your future. Prepare to have your perspective shifted.

Beyond the Headlines: What the Jobs Report Really Means

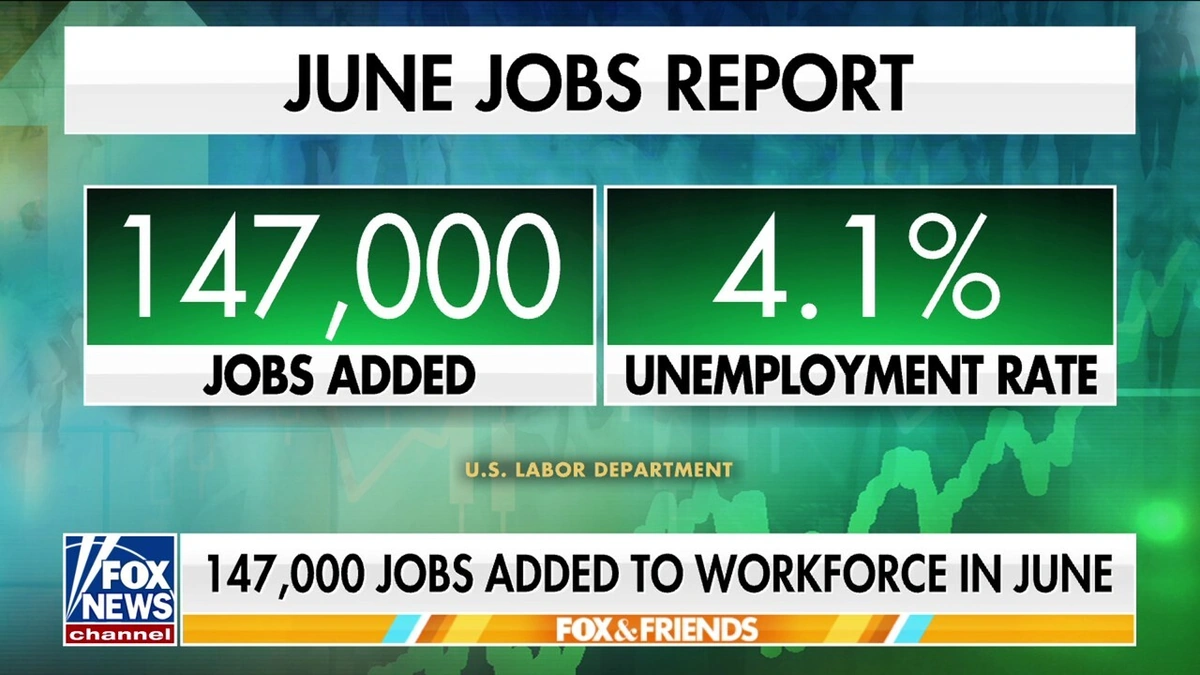

So, the latest jobs report is out. Let’s say it shows a slight uptick in the unemployment rate . The talking heads on TV will tell you whether that’s “good” or “bad.” But I want to tell you why it matters, because the truth is, it’s almost never that simple.

A rising unemployment rate , even a small one, can signal several things. It might mean companies are starting to feel the pinch and are laying off workers. It could mean people are entering the labor force, actively searching for jobs for the first time or after a long absence, which temporarily inflates the rate. Or maybe, just maybe, it’s a correction after a period of unsustainable growth. These factors paint a fuller picture of what’s actually going on in the labor market.

See, the devil is in the details. What sectors are losing jobs? What sectors are gaining? Are these full-time positions or part-time gigs? A loss of manufacturing jobs is a vastly different signal than a loss of retail jobs. The labor force participation rate , the number of employed as well as those actively seeking jobs, reveals the overall health of the economy.

The Impact on Your Wallet: How the Unemployment Rate Affects You

Okay, enough macroeconomics. Let’s get practical. How does this affect you? Well, a high unemployment rate can put downward pressure on wages. Employers know they have a larger pool of candidates to choose from, so they don’t have to offer as much to attract talent. This is often referred to as wage stagnation . But, a very low unemployment rate can trigger wage inflation as firms fiercely compete for workers.

But it’s not just about wages. Job security becomes a bigger concern when the unemployment rate is high. You might be less likely to ask for that raise or push back on extra responsibilities if you’re worried about being replaced. On the flip side, a healthy job market empowers you to negotiate better terms and pursue new opportunities. That feeling of security – it’s priceless.

I initially thought this was straightforward but then I realized that the types of jobs being added or lost also affect your personal financial planning. The key is to understand the trends in your industry and adapt accordingly.

Beyond the Numbers: Labor Market Trends and What They’re Saying

Now, let’s zoom out and look at the bigger picture. What are the underlying labor market trends driving these numbers? Are we seeing a shift towards automation? Is the gig economy reshaping the way people work? Is there a skills gap that’s preventing people from finding good-paying jobs? These are the kinds of questions we need to be asking. It’s crucial to consider the average hourly earnings alongside these factors to have a holistic view of the average American’s financial well being.

Here’s the thing: the jobs report is a snapshot in time. It doesn’t tell you why these trends are happening or what we can do about them. That’s where thoughtful analysis comes in. For example, a rise in temporary jobs may signal a rise in economic uncertainty.

The Bureau of Labor Statistics (BLS) , which releases the report, also provides other insightful metrics like the underemployment rate , which is the percentage of workers who are either unemployed, working part-time but desiring full-time employment, or have quit searching for work in the last year. It goes to show there’s more than one way to measure an economy’s labor strength. It is important to view this data within the context of other financial indicators such as the inflation rate and the GDP growth .

Interpreting Industry-Specific Employment Statistics

It’s easy to get lost in the broad strokes of the jobs report , but understanding the nuances within specific industries can provide more actionable insights. Let’s say the leisure and hospitality sector shows a significant increase in jobs. While that might seem like good news on the surface, it could also indicate a shift towards lower-paying, less stable positions. A common mistake I see people make is assuming all job growth is equal, without looking at the industry sectors.

Conversely, a decline in manufacturing jobs, even if offset by gains in other sectors, could signal a weakening of the industrial base and potential long-term economic challenges. Looking at the employment statistics for your particular field may also help you anticipate and plan career moves.

The key takeaway is that the overall unemployment rate is just one piece of the puzzle. Understanding the industry-specific trends driving the numbers is crucial for making informed decisions about your career and finances.

Remember, every sector and region is unique. The national unemployment rate hides regional disparities. It’s vital to drill down into state and local data for a true grasp of economic conditions.

Navigating Economic Uncertainty | How to Prepare for What’s Next

So, what’s the bottom line? The jobs report is more than just a collection of numbers. It’s a window into the health of the economy and a glimpse into your financial future. And in our increasingly uncertain world, understanding these trends is more important than ever. Economic uncertainty is the new normal.

The one thing you absolutely must do is stay informed. Don’t just read the headlines; dig into the data. Understand the underlying trends and how they might affect you. Talk to experts, read credible sources, and form your own informed opinions. A focus on continuous education and upskilling are keys to staying relevant in any professional capacity.

The path to economic security lies in understanding the story the numbers are trying to tell you. If you invest the time to learn, you will see a return on that investment.

FAQ | Understanding the Jobs Report

What if I don’t understand all the terminology in the jobs report?

No worries! The Bureau of Labor Statistics (BLS) has a glossary of terms on their website. Start there.

How often is the jobs report released?

The jobs report is released monthly, usually on the first Friday of the month.

What’s the difference between the unemployment rate and the labor force participation rate?

The unemployment rate is the percentage of people actively looking for work who can’t find it. The labor force participation rate is the percentage of the population that is either employed or actively looking for work.

Why does the jobs report sometimes get revised?

The initial jobs report is based on preliminary data. As more data becomes available, the BLS revises the numbers to provide a more accurate picture.