Let’s be honest, the world of retirement savings can feel like navigating a maze. Jargon flies around – vesting schedules, employer matches, contribution limits – and it’s easy to get lost. But here’s the thing: understanding your 401(k) is absolutely crucial for securing your financial future. It’s not just about stashing away some money; it’s about making informed decisions that can significantly impact your long-term wealth. We’re going to explore some things that aren’t often discussed about 401(k)s, and that’s where the real value lies.

The “Why” Behind Your 401(k) – More Than Just Retirement

So, why should you even bother with a 401(k)? Sure, retirement is the obvious answer, but it goes deeper than that. A 401(k) isn’t just a savings account; it’s a powerful tool for building wealth and achieving financial independence. It’s a way to harness the power of compounding, allowing your investments to grow exponentially over time. And, critically, it offers tax advantages that can save you serious money now and in the future. Think of it as planting a tree today so you can relax in its shade later. Investing for retirement is a long game. It is a marathon and not a sprint.

One thing I find that’s often overlooked is the flexibility a 401(k) can provide, especially when it comes to potential hardships. Many plans allow for loans or withdrawals in specific circumstances, such as medical expenses or home purchases. But, of course, you should carefully consider the implications of borrowing from your 401(k). Consult with a financial advisor before taking any loans out on your retirement savings .

Cracking the Code | Contribution Limits and Maximizing Your Match

Let’s talk numbers. Understanding contribution limits is key to maximizing the benefits of your 401(k). The IRS sets annual limits on how much you can contribute, and these limits can change from year to year. Stay updated on the latest figures to ensure you’re taking full advantage of the tax-advantaged savings. As of 2024, the employee 401(k) contribution limit is $23,000. For people age 50 and over, the limit is $30,000. So, it’s very important to know your limits.

And speaking of maximizing, don’t leave money on the table! Many employers offer a 401(k) match , which is essentially free money. If your employer matches 50% of your contributions up to a certain percentage of your salary, make sure you contribute enough to get the full match. This is one of the easiest and most effective ways to boost your retirement savings.

Here’s the thing: if your company offers dollar-for-dollar matching, that is a 100% return on your investment. Where else can you find that type of investment return?

Beyond Stocks and Bonds | Diversifying Your 401(k) Investments

Don’t make the mistake of setting it and forgetting it! Your 401(k) isn’t just a vault for cash; it’s a portfolio of investments. And like any portfolio, it needs to be diversified. While stocks and bonds are the traditional staples, consider exploring other asset classes, such as real estate investment trusts (REITs) or international funds. Real estate is a great investment, and including REITs in your portfolio can increase your returns.

Diversification helps to mitigate risk and potentially enhance returns. It’s about spreading your investments across different sectors and asset classes so that if one area underperforms, others can cushion the blow. I initially thought this was straightforward, but then I realized that many people simply choose the default options provided by their plan, without considering their individual risk tolerance or financial goals. You have many options to invest in, so don’t stick with the default investment.

And, remember, your investment strategy should evolve over time as you get closer to retirement. You might want to shift towards a more conservative approach as you near your target date, reducing your exposure to volatile assets.

Fees, Fees, and More Fees | Understanding the Hidden Costs

Okay, let’s talk about something nobody likes: fees. 401(k) fees can eat into your returns over time, so it’s essential to understand what you’re paying and how to minimize these costs. There are various types of fees, including administrative fees, investment management fees, and transaction fees. Request a breakdown of the fees associated with your plan and compare them to industry averages.

One thing you want to do is look at the expense ratios for each of the funds you are invested in. A lower expense ratio means that you are paying less in fees.

And here’s a pro tip: consider investing in index funds or exchange-traded funds (ETFs), which typically have lower fees than actively managed funds. This is very important because actively managed funds don’t guarantee higher returns, but they do guarantee higher fees.

The Power of Compounding | Time is Your Greatest Asset

Here’s where the magic happens: compounding. Compounding is the process of earning returns on your initial investment and on the accumulated interest. It’s like a snowball rolling downhill, growing bigger and faster as it goes. The earlier you start saving, the more time your money has to grow through compounding.

What fascinates me is how even small, consistent contributions can lead to significant wealth over the long term, thanks to the power of compounding. Consider this: even if you only contributed $100 a month into your 401k, you can still end up with a sizable amount of money when you retire.

Don’t underestimate the impact of starting early. Even if you can only afford to save a small amount now, it’s better than waiting. Time is your greatest asset when it comes to compound interest .

The Prime Rate will impact your 401k. Make sure to consult with a financial expert to optimize your savings.

FAQ | Your Burning 401(k) Questions Answered

Frequently Asked Questions

What if I change jobs? What happens to my 401(k)?

You have several options: you can leave your money in your former employer’s plan (if the plan allows it), roll it over into an IRA, or roll it over into your new employer’s 401(k) plan.

Can I withdraw money from my 401(k) before retirement?

Yes, but it’s generally not recommended. Withdrawals before age 59 1/2 are typically subject to a 10% penalty, as well as income taxes. There are a few exceptions, such as for certain medical expenses or financial hardships.

How do I choose the right investments for my 401(k)?

Consider your risk tolerance, time horizon, and financial goals. If you’re unsure, consult with a financial advisor.

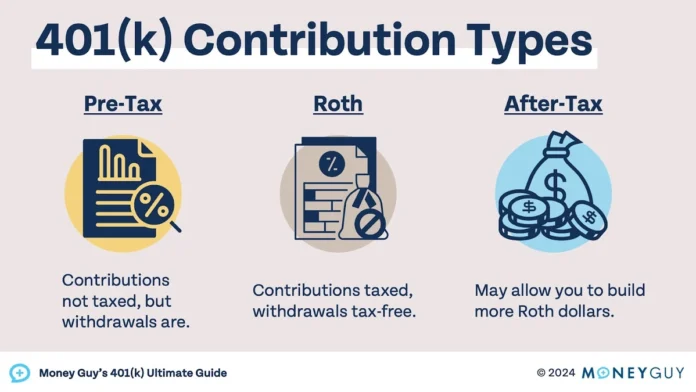

What are the tax advantages of a 401(k)?

Traditional 401(k) contributions are made on a pre-tax basis, which means they can reduce your taxable income. The money grows tax-deferred, and you’ll pay taxes on withdrawals in retirement. Roth 401(k) contributions are made after-tax, but withdrawals in retirement are tax-free.

What is a 401(k) rollover?

A 401(k) rollover is the process of moving money from one retirement account to another without triggering taxes or penalties. This is often done when changing jobs or consolidating retirement accounts.

Ultimately, your 401(k) is one of the most important tools for securing your financial future. And you have so many options to make sure it’s optimized for your individual circumstances.