So, you’re thinking about buying a house, huh? Or maybe you’re considering refinancing your current mortgage? Either way, the first thing that probably pops into your head (besides the mountain of paperwork) is: mortgage interest rates . Let’s be honest, it’s a confusing landscape out there. It’s not just about the numbers you see advertised; it’s about understanding why those numbers are what they are and, more importantly, what they mean for you. I initially thought understanding mortgage rates was just about comparing numbers, but the more I researched, the more I realized it’s about understanding the entire economic ecosystem.

Why Are Mortgage Interest Rates So Volatile?

Here’s the thing: Mortgage rates don’t exist in a vacuum. They’re more like a barometer, constantly reacting to shifts in the broader economic climate. Think of it as a complex dance between inflation, economic growth, and the Federal Reserve’s moves. Let’s break it down, shall we?

First, inflation. When prices for everyday goods and services rise, the Fed often steps in to cool things down by raising the federal funds rate. This, in turn, pushes up borrowing costs across the board, including home loan interest rates . A rise in inflation can quickly translate to higher monthly payments. On the flip side, if the economy is sluggish and inflation is low, the Fed might lower rates to stimulate borrowing and spending.

And then there’s the 10-year Treasury yield. This is essentially the interest rate the government pays to borrow money for 10 years. It acts as a benchmark for mortgage rates, because lenders use it as a proxy for long-term economic confidence. When investors are feeling optimistic, the 10-year yield tends to rise, pulling mortgage rates up with it. A dip in yields often signals economic uncertainty and lower rates.

This is where the “why” becomes so important. Because understanding this dance helps you anticipate future movements and make smarter decisions. For example, let’s say economic indicators show a surge in inflation. If that’s the case, consider locking in a rate sooner rather than later. But, if economists predict a slowdown, holding off might be beneficial. As per the guidelines mentioned on Investopedia , understanding these trends is the first step in making informed decisions.

Decoding Different Mortgage Types | Fixed vs. Adjustable

Okay, now that we’ve established the economic backdrop, let’s dive into the nitty-gritty: the types of mortgage products available. The two main contenders are fixed-rate mortgages and adjustable-rate mortgages (ARMs). What fascinates me is how people choose between these. It all comes down to risk tolerance and your long-term plans.

Fixed-rate mortgages are the steady Eddies of the mortgage world. You get a set interest rate for the entire life of the loan – usually 15, 20, or 30 years. This provides predictability and peace of mind. However, because you’re getting that guarantee, fixed rates are typically higher than the initial rates on ARMs.

ARMs, on the other hand, are a bit more adventurous. They start with a lower introductory rate that’s fixed for a specific period (e.g., 5 years, 7 years). After that, the rate adjusts periodically based on a benchmark index plus a margin determined by the lender. This means your monthly payments can go up or down. ARMs can be attractive if you plan to move before the adjustment period or if you believe interest rates will decline. What I have come to find is that , most people opt for fixed rates.

How Credit Scores Impact Your Interest Rate

Here’s the cold, hard truth: your credit score is your financial report card, and lenders use it to assess your risk as a borrower. A higher score signals to lenders that you’re responsible with credit, making you a less risky bet. The lower your credit score, the higher your interest rate will likely be. According to the FTC , maintaining a good credit score can save you thousands over the life of a loan.

A common mistake I see people make is not checking their credit report before applying for a mortgage. This is crucial! You want to identify and correct any errors that could be dragging down your score. Get a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com.

But even if your credit score isn’t perfect, don’t despair. There are steps you can take to improve it. Pay your bills on time, reduce your credit card balances, and avoid opening new accounts unnecessarily. Even a small increase in your credit score can make a big difference in the interest rate you qualify for.

Strategies for Securing the Best Mortgage Rate

Alright, let’s talk strategy. You’ve done your homework, understand the economic factors, and know your credit score. Now, how do you actually snag the best possible mortgage rate ?

First, shop around! Don’t settle for the first offer you receive. Get quotes from multiple lenders – banks, credit unions, and online lenders. Each lender has its own underwriting criteria and pricing models, so rates can vary significantly. To add to this, consider employing a mortgage broker . These financial professionals work with multiple lenders and can help you find the best rate and terms for your specific situation. Many people don’t realize how helpful they can be.

Second, consider increasing your down payment. The more money you put down, the less you need to borrow, and the lower your risk to the lender. This can translate to a lower interest rate and potentially eliminate the need for private mortgage insurance (PMI), saving you even more money. While sources suggest a specific percentage, the benefits of a larger down payment remain constant. It’s best to consult with a financial advisor to determine what works best for your financial situation.

And finally, don’t be afraid to negotiate. Lenders want your business, and they may be willing to match or beat a competitor’s offer. Be polite, be persistent, and be prepared to walk away if you’re not getting the rate you deserve. Understanding the current housing market can also impact the negotiating process.

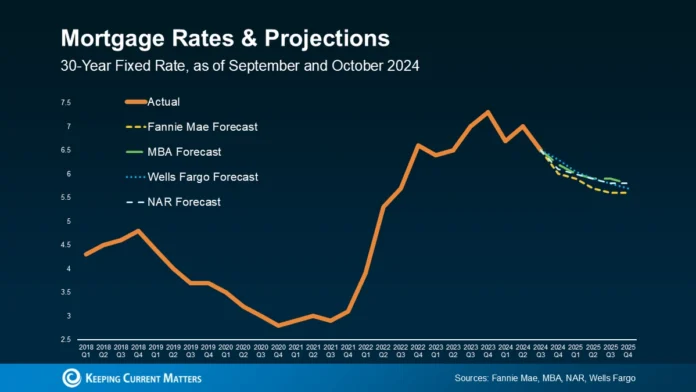

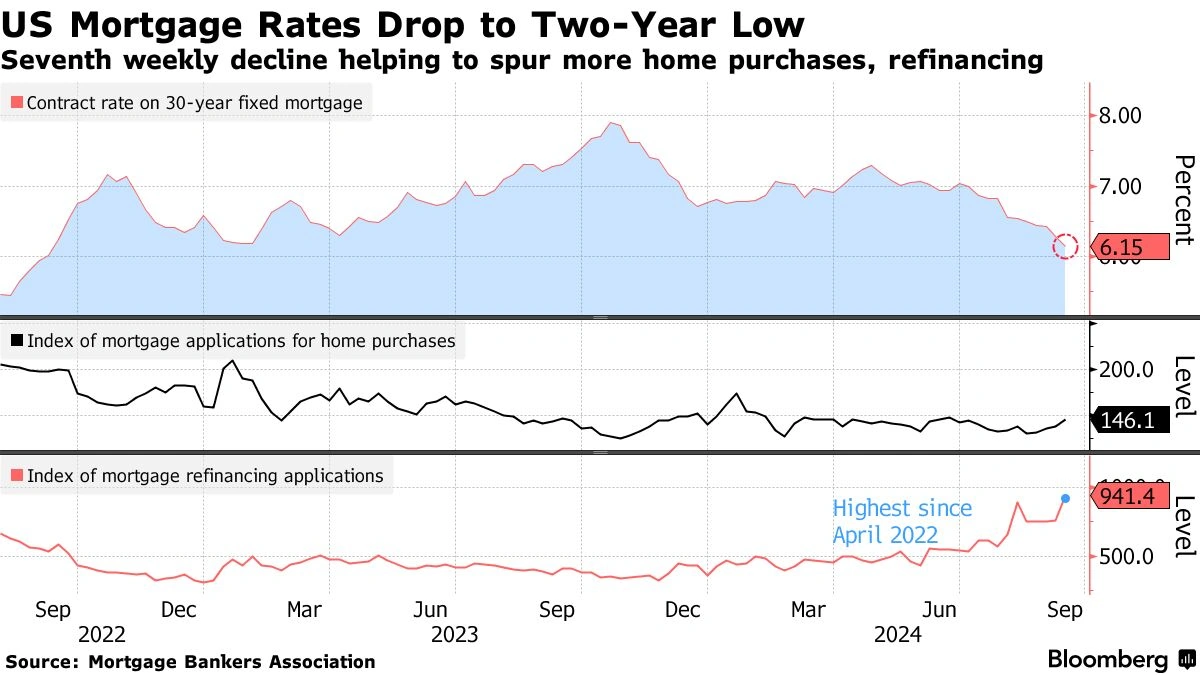

The Future of Mortgage Rates | What’s on the Horizon?

Predicting the future is always a tricky business. But, by keeping an eye on economic trends, the Fed’s actions, and geopolitical events, you can get a sense of where mortgage rate trends are headed. Pay close attention to inflation reports, employment data, and any major policy announcements from the Federal Reserve. These factors will continue to shape the landscape in the months and years ahead. I’ve noticed that the best time to invest is when rates are low.

While no one has a crystal ball, staying informed will empower you to make well-informed decisions about your mortgage, whether you’re buying your first home, refinancing your current loan, or simply keeping an eye on the market. Good luck!

FAQ | Mortgage Interest Rates Demystified

What exactly is an APR, and how does it differ from the interest rate?

APR stands for Annual Percentage Rate. It includes the interest rate plus other costs associated with the loan, such as points, fees, and mortgage insurance. It’s the actual cost of borrowing.

What if my application is denied?

Find out why! Lenders must provide a reason for denial. Address the issue and reapply or seek a different lender.

How do I improve my chances of getting approved for a mortgage with a low rate?

Boost your credit score, reduce debt, save for a larger down payment, and shop around for the best rates.

Are there any government programs to help first-time home buyers?

Yes! Look into FHA loans, VA loans, and USDA loans, which offer lower down payments and easier qualification requirements for eligible borrowers.

Should I lock in my interest rate now, or wait?

This depends on your risk tolerance and expectations for future rate movements. If you believe rates will rise, locking in now might be wise. If you expect rates to fall, waiting could save you money.

What are points, and are they worth paying for?

Points are upfront fees you pay to the lender in exchange for a lower interest rate. Whether they’re worth it depends on how long you plan to stay in the home and how much you’ll save in interest over time.