So, you’ve heard the term ” open stock ” floating around, maybe in the context of investing or even shopping. But what does it really mean? And, more importantly, why should you care? Here’s the thing: understanding the nuances of open stock can actually impact your financial decisions and even how you approach everyday purchases. Let’s dive in, shall we?

What Is Open Stock, Anyway? A No-Nonsense Explanation

Let’s be honest, financial jargon can be a real drag. Simply put, open stock refers to items or collections of items that are sold individually rather than as a complete set. Think of it like this: a dinnerware set usually comes with plates, bowls, cups, etc. But if you can buy those plates individually, that’s ” open stock .”

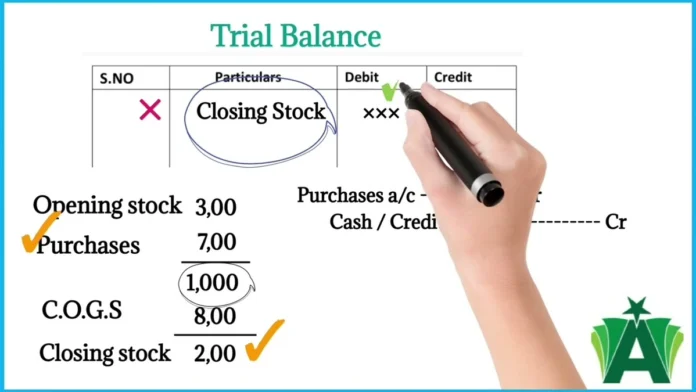

In the investing world, the term takes on a slightly different meaning. It relates to a company’s shares that are available for purchase by the public on the stock market . This is distinct from privately held stock, which is not available to the general public. A common mistake I see people make is assuming that all stocks are created equal. Publicly traded stocks allow anyone with a brokerage account to buy and sell shares, offering liquidity and price discovery based on supply and demand.

Open Stock vs. Closed Stock | Spotting the Differences

Now, to really nail down what open stock is, it helps to understand its counterpart: closed stock. Consider something like a limited-edition watch set. You can only buy it as a set; the individual components aren’t sold separately. That’s closed stock. This distinction matters because it affects things like pricing, availability, and even collectibility. When it comes to investing, a company with closed stock, or one that isn’t publicly traded, means you can’t just jump in and buy a share. You’d need to explore other avenues, like private equity or venture capital – entirely different ballgames! According to Investopedia, understanding the difference between public companies and private ones is crucial for any investor.Learn more here.

Why Open Stock Matters | The Upsides and Downsides

So why should you even care about open stock? For starters, it gives you flexibility. Need just one extra plate? Open stock to the rescue! But there are downsides too. Sometimes, buying items individually ends up being more expensive than buying a complete set. What fascinates me is how this concept extends beyond just dinnerware. Think about car parts, clothing items, even components for building computers. The ability to purchase piecemeal offers convenience, but it’s worth weighing against the potential cost savings of buying in bulk or as a set.

From an investment standpoint, open stock, or shares available to the public, offer incredible opportunity. But they also come with risk. Stock prices can fluctuate wildly based on market sentiment, economic conditions, and company performance. That’s why due diligence is essential. A common mistake I see new investors make is chasing hot stocks without understanding the underlying financials. Remember: invest responsibly and always do your homework.

Navigating the Open Stock Landscape | Tips and Tricks

Okay, so you’re ready to dive into the world of open stock, whether for shopping or investing. Here’s some practical advice:

- Shopping: Compare prices! Just because something is available individually doesn’t mean it’s the best deal. Check the cost of buying a set versus individual pieces.

- Investing: Do your research. Understand the company, its financials, and the industry it operates in. Don’t just follow the hype. Consider consulting a financial advisor .

I initially thought this was straightforward, but then I realized that the stock trading landscape is more complex than it appears. Different brokerage platforms offer varying levels of tools and resources. Some charge commissions, while others offer commission-free trading. It’s crucial to understand the fees and features before choosing a platform. As per the guidelines mentioned by leading brokerage firms, selecting the right platform can significantly impact your investment returns.

The Future of Open Stock | Trends and Predictions

Where is open stock headed? In retail, I think we’ll see even more customization options. Think personalized sets where you can choose exactly which items you want. As for investing, the rise of fractional shares is making open stock even more accessible to smaller investors. Fractional shares allow you to buy a portion of a share, meaning you don’t need to shell out hundreds (or thousands!) of dollars to invest in a particular company. This democratizes investing and makes it easier for anyone to get started. Also, keep an eye on stock market volatility , as this can greatly affect investment decisions. But, technological advancements may also bring new risks such as cybersecurity threats and the spread of misinformation. It’s best to stay vigilant and informed.

Another element to consider is the prevalence of initial public offerings (IPOs). When a private company goes public, it offers its shares as open stock for the first time. These events often generate significant buzz, but they can also be quite risky. IPOs are inherently speculative, and the price can be highly volatile in the initial days and weeks of trading. A detailed prospectus will give you insight into a company’s financials. You can also see examples of profitable stock in companies like LULU stock , which shows the potential returns with calculated risk.

FAQ | Your Open Stock Questions Answered

Frequently Asked Questions

What’s the difference between open stock and closeout items?

Open stock refers to items sold individually, while closeout items are typically discontinued products sold at a discount to clear inventory.

Is open stock always more expensive?

Not always. It depends on the product and the retailer. Always compare prices before making a purchase.

How can I find the best deals on open stock investments?

Research companies thoroughly, compare brokerage fees, and consider using a financial advisor.

What if I buy open stock and later want the complete set?

Check with the retailer to see if the complete set is still available. It might be challenging to complete a set later on.

Are there risks associated with open stock trading?

Yes, investing in stocks always involves risk. Market volatility, company performance, and economic conditions can all impact stock prices.

So, there you have it. Open stock demystified! Whether you’re hunting for that one perfect plate or navigating the complex world of investing, understanding this concept can help you make smarter decisions and ultimately, get more value for your money. Keep learning, keep questioning, and keep exploring the fascinating world of…stuff!