Okay, so you’ve heard about the PCE inflation report . Maybe you saw it flash across your news feed or overheard someone talking about it at the coffee shop. But let’s be honest do you really know what it is and why it should matter to you, sitting there trying to make rent and maybe save a little something? I thought so.

Here’s the thing: the PCE, or Personal Consumption Expenditures Price Index , is like the Federal Reserve’s favorite yardstick for measuring inflation. It’s not as flashy as the Consumer Price Index (CPI), which gets all the headlines, but many economists believe the PCE is actually a more accurate reflection of what’s happening with prices. And that’s because of how it’s calculated.

Unlike the CPI, the PCE can account for changes in consumer behavior. If the price of steak goes through the roof, people might switch to chicken. The PCE will pick up on that shift, giving a more realistic picture of spending habits. I initially thought this was straightforward, but then I realized the implications are pretty far-reaching.

What’s Actually in the PCE?

So, what makes up the PCE? Everything from groceries and gasoline to healthcare and housing. It’s a comprehensive look at what Americans are buying. But it’s not just about what we buy, but how much we spend on each item. That’s where the weighting comes in. If housing costs make up a larger portion of your budget, they’ll have a bigger impact on the overall PCE number.

And, it takes into account the substitutes that people switch to when prices rise. It also incorporates data from businesses in addition to household surveys, giving it an added layer of accuracy. All of this data is compiled and released monthly by the Bureau of Economic Analysis (BEA). You can find the data on theBEA website, but honestly, it can be a bit dry.

Why the Fed Obsesses Over It (And You Should Too)

The Federal Reserve has a target inflation rate of 2%. They use the PCE to determine whether or not they’re hitting their mark. If inflation is too high, the Fed may raise interest rates to cool things down. If it’s too low, they might lower interest rates to stimulate the economy. Those interest rate decisions impact everything from mortgage rates to credit card interest to rates on stocks.

Now, let me rephrase that for clarity. The Fed does NOT directly control gas prices. But it does influence the financial conditions that impact businesses’ ability to invest and expand. If borrowing money becomes more expensive, companies might pull back on hiring and wage increases. And that’s why it’s essential to pay attention to how the Fed is behaving in response to the core PCE inflation rate .

How the PCE Report Impacts Your Day-to-Day Life

Here’s where it hits home. Let’s say the latest PCE report shows inflation is stubbornly high. The Fed responds by raising interest rates again. What does this mean for you? Well, if you’re planning to buy a house, your mortgage rates will likely go up. If you’re carrying a balance on your credit card, you’ll be paying more in interest. Businesses might slow down hiring or even lay off workers if they’re struggling with higher borrowing costs. It’s all connected.

On the other hand, if the PCE report shows that inflation is cooling down, the Fed might pause or even reverse course. That could lead to lower interest rates, making it cheaper to borrow money and potentially boosting the economy. If businesses see lower costs, they may invest more or give employees raises.

Beyond the Headline | Dissecting the Details

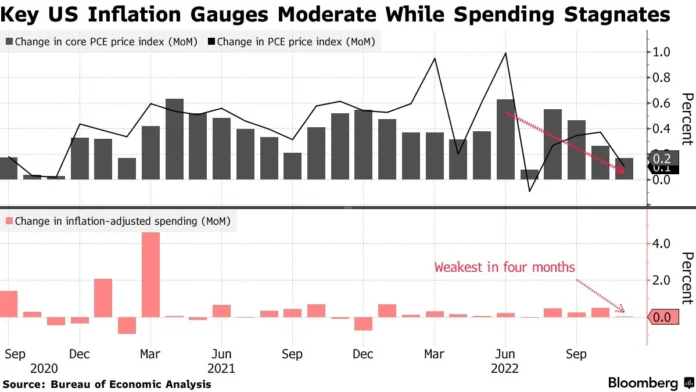

The headline number is important, but it’s also worth digging a little deeper. Look at the monthly PCE inflation figure versus the annual rate. A month can offer a much more up-to-date perspective. Also, pay attention to the core PCE, which excludes volatile food and energy prices. This gives a clearer picture of underlying inflation trends.

What fascinates me is how different sectors contribute to the overall inflation number. Are rising healthcare costs driving inflation, or is it primarily energy prices? Understanding the source of inflation can help you anticipate how it might affect you personally. Consider tracking the PCE alongside other economic indicators, such as GDP growth and employment figures. I see people make assumptions based on the surface level reporting. It’s important to understand how it affects your pocket book.

What the Experts Are Saying (And Why You Should Be Skeptical)

You’ll undoubtedly see a flurry of commentary from economists and financial analysts after the PCE report is released. Some will say it’s a sign that the Fed needs to do more to fight inflation. Others will argue that it’s a signal that the Fed is on the right track. Take all of that with a grain of salt. Financial forecasts are often wrong (let’s be honest here!).

Instead of blindly following expert opinions, focus on understanding the data yourself and how it might impact your own financial situation. According to the latest economic data, trends can shift dramatically in a short period. That’s why it’s best to consult the official publications of the U.S. Department of Commerce. Keep in mind, it’s essential to consider your individual situation. Are you close to retirement? Are you planning to make a large purchase soon? Your priorities will determine the most important takeaways.

FAQ | Unpacking the PCE Jargon

What if I hear about “deflation”?

Deflation is the opposite of inflation a general decrease in prices. While it might sound good, it can actually be harmful to the economy.

What’s the difference between PCE and CPI?

Both measure inflation, but the PCE uses a different formula and includes a broader range of goods and services.

Why does the Fed prefer the PCE?

Many economists think the PCE is a more accurate measure of inflation because it accounts for changes in consumer behavior.

Will the PCE report help me time the market?

Probably not. It’s one piece of the puzzle, but it’s not a crystal ball.

How often is the PCE report released?

Monthly, usually towards the end of the month.

Ultimately, the latest PCE inflation report is more than just a number. It’s a window into the health of the economy and a glimpse at how it might impact your financial future. So, next time you see that headline, take a moment to dig a little deeper. Your wallet will thank you for it.

Understanding that it’s influenced by various factors, including government spending and global economic conditions, is essential.

So, are we doomed? Absolutely not. We just need to understand the signals and adjust accordingly. And that, my friend, is empowerment.