Alright, let’s talk about the pce report today . But not in that dry, economics-textbook way. Let’s be honest, most financial news feels like it’s written in another language. What fascinates me is how these reports, often buried under jargon, actually impact your everyday life. And that’s what we are going to explore. This isn’t just about numbers; it’s about what those numbers mean for your wallet, your job, and the overall economy. Think of me as your friendly translator, breaking down the complex stuff into something you can actually use.

What Exactly IS the PCE, Anyway? (And Why Should You Care?)

Okay, so the Personal Consumption Expenditures (PCE) price index. Catchy, right? Not really. It’s a measure of the prices that people living in the United States pay for goods and services. The Federal Reserve actually prefers the PCE to the Consumer Price Index (CPI) as an inflation gauge. Why? The PCE considers changes in consumer behavior. If steak prices skyrocket, people might switch to chicken. The PCE captures that shift more accurately, providing a more comprehensive picture of inflation. The core PCE excludes volatile food and energy prices, giving an even clearer view of underlying inflation trends. A common mistake I see people make is dismissing these reports as irrelevant. But they influence everything from interest rates to investment decisions.

And believe me, understanding the latest pce data is crucial. Think of it as the Fed’s report card on inflation.

Decoding Today’s PCE Report | Key Takeaways

Here’s the thing: Simply regurgitating the numbers from the pce inflation report doesn’t tell you anything. You can find that on any financial news site. What we need to do is analyze them and see what they really mean. I initially thought this report would follow the previous trends, but then I realized the subtleties could tell a different story. Let’s get into some examples:

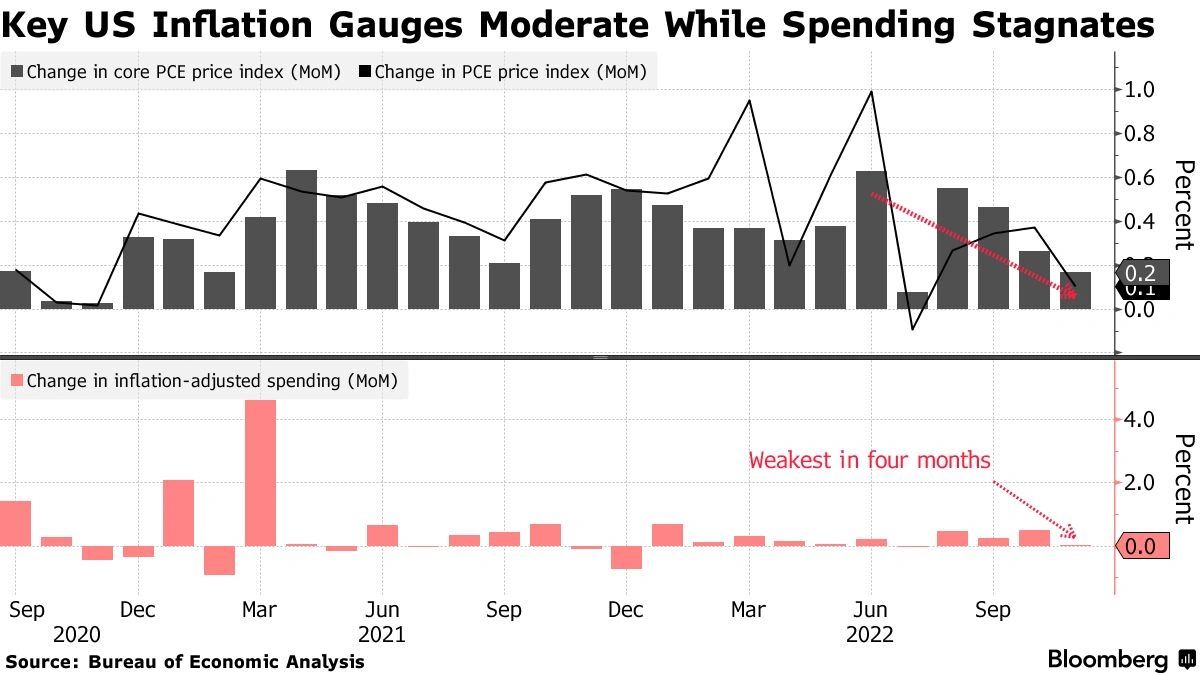

- Was there an unexpected uptick in core inflation? That could signal that the Fed might hold off on cutting interest rates.

- Did consumer spending slow down? That might suggest the economy is cooling off, which could eventually lead to job losses.

- Are energy prices driving the overall inflation number? If so, that could be temporary, and the Fed might be less concerned.

These nuances matter! This analysis will help you understand the implications of today ‘s report beyond the headlines.

How the PCE Report Affects Your Investments

The pce price index directly impacts investment strategies. If the report signals persistent inflation, the Fed is more likely to maintain or even raise interest rates. This can lead to a decrease in bond prices and potentially impact the stock market, especially growth stocks that are sensitive to interest rate changes. Value stocks, on the other hand, might fare better in an inflationary environment. Understanding these dynamics helps you make informed decisions about your portfolio allocation. For example, let’s say the PCE report shows that inflation is stubbornly high. In that case, you might consider diversifying your portfolio with inflation-protected securities or commodities.

A common mistake I see people make is reacting emotionally to market fluctuations triggered by these reports. Remember, long-term investing is a marathon, not a sprint.

What to Watch For in Future PCE Reports

Looking ahead, it’s crucial to monitor several key indicators within the monthly pce report . First, pay close attention to the core PCE, as this is the Fed’s preferred inflation measure. Also, keep an eye on consumer spending trends. Are people still spending, or are they starting to tighten their belts? This can provide valuable insights into the overall health of the economy. As per the guidelines mentioned in the information bulletin, it’s also important to compare the current report to previous months and years to identify any emerging trends. A sustained increase in inflation could signal a need for further Fed action, while a slowdown in consumer spending might indicate a potential recession. The one thing you absolutely must double-check each month is the revision to the previous month’s data. These revisions can sometimes be significant and can alter your interpretation of the overall trend.

PCE Report | Is the Fed on Track?

Ultimately, the PCE report acts as a critical indicator of whether the Federal Reserve’s monetary policy is effective. If inflation is trending towards the Fed’s 2% target, it suggests that their policies are working. However, if inflation remains stubbornly high or starts to accelerate, it could force the Fed to take more aggressive action, potentially leading to a recession. What fascinates me is how the Fed balances these competing risks. They want to control inflation, but they also don’t want to trigger a sharp economic downturn. It’s a delicate balancing act, and the PCE report provides valuable data to guide their decisions. I’ve seen the Fed pivot quickly based on these reports, so stay sharp!

FAQ | Understanding the PCE Report

What if I’m confused by all the economic jargon?

Don’t worry! Financial news can be overwhelming. Focus on understanding the key takeaways and how they might impact your personal finances.

How often is the PCE report released?

The Bureau of Economic Analysis (BEA) releases the PCE report monthly.

What’s the difference between the PCE and the CPI?

Both measure inflation, but the PCE considers changes in consumer behavior, making it a more comprehensive measure.

Where can I find the official PCE report?

You can find it on the Bureau of Economic Analysis (BEA) website: www.bea.gov .

How does the federal reserve use this report?

The Fed uses the PCE report, and especially core PCE, as a key gauge for inflation trends when making decisions about monetary policy and interest rates.

Is consumer spending a part of this report?

Yes. It includes data on how much people are spending on goods and services.

So, there you have it. The PCE report isn’t just a bunch of numbers; it’s a window into the health of the economy and a crucial tool for making informed financial decisions. What fascinates me is how something that seems so abstract can have such a real-world impact. And hopefully, now it makes sense to you, too. Remember, stay informed, stay curious, and don’t be afraid to dig deeper than the headlines.