PepsiCo just dropped its Q3 earnings report, and while the headline screams “success,” let’s be honest: things are a bit more nuanced than they appear. Sure, the company is boasting about robust Q3 sales , but a closer look reveals a significant slowdown in North America. So, what’s really going on? That’s what we’re diving into today. Is this a blip, or a sign of bigger shifts in consumer behaviour? Let’s find out.

Decoding the Numbers | More Than Just Soda

Okay, first things first. What exactly does “robust” mean in PepsiCo’s world? Well, net revenue increased, driven by international markets. But here’s the thing: North America, PepsiCo’s largest market, experienced a noticeable deceleration. This is where things get interesting. Are people suddenly ditching their Mountain Dew for healthier options, or is something else at play? Maybe inflation is finally catching up, even with the comfort-food-and-beverage giants. I initially thought this was straightforward, but then I realised we need to unpack each segment individually.

For example, PepsiCo’s beverage sales might be facing headwinds due to changing consumer preferences. People are getting more health-conscious, and sugary drinks are often the first to go. But, their snack division, which includes brands like Lays and Doritos, might be faring better because, let’s face it, who can resist a bag of chips during a stressful week? So, it’s not just about overall sales; it’s about where the growth (or slowdown) is happening.

The India Angle | Why Emerging Markets Matter

Now, let’s talk about India. While North America stumbles a bit, emerging markets like India are often the engines driving growth for these multinational behemoths. Here’s the thing: India’s massive population, coupled with a growing middle class, makes it a prime target for PepsiCo’s global strategy . And, consumption patterns in India are often different from those in developed countries. There’s a huge demand for affordable snacks and beverages, and PepsiCo is strategically positioned to capitalize on this. But competition in the Indian market is fierce. Local players are upping their game, and PepsiCo needs to constantly innovate to stay ahead. Think about it – are they adapting their product lines to cater to Indian tastes? Are they investing in local manufacturing and distribution networks? These are the questions that will determine their long-term success in India.

Inflation, Supply Chains, and the Price of a Pepsi

Let’s be honest, we can’t talk about sales without talking about inflation. Rising costs of raw materials, packaging, and transportation are putting pressure on PepsiCo’s profit margins . And, it’s not just PepsiCo; the entire food and beverage industry is grappling with these challenges. So, how are they responding? Well, one way is by raising prices. But, there’s a limit to how much consumers are willing to pay for a can of soda or a bag of chips. At some point, they might switch to cheaper alternatives or cut back on discretionary spending. Another strategy is to optimize supply chains. This means finding ways to source ingredients more efficiently, reduce transportation costs, and minimize waste. It’s a complex balancing act, and PepsiCo’s ability to navigate these challenges will be crucial for maintaining profitability.

What Does This Mean for the Future of PepsiCo (and Your Portfolio)?

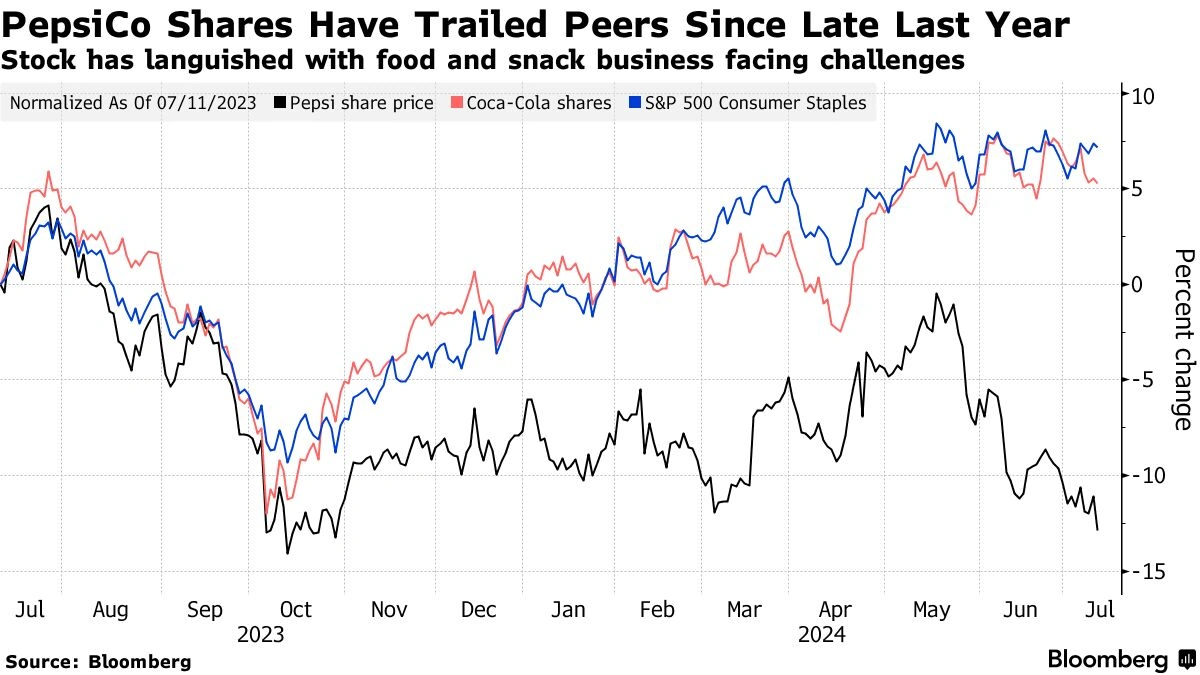

So, what’s the takeaway? PepsiCo’s Q3 results are a mixed bag. While overall sales are up, the slowdown in North America is a cause for concern. But, the company’s strong performance in emerging markets offers a glimmer of hope. As an investor (or just someone curious about the economy), here’s what fascinates me is the long-term strategy. Are they doubling down on healthier options? Are they investing in sustainable packaging? Are they building stronger relationships with local communities? These are the factors that will determine whether PepsiCo can continue to thrive in a rapidly changing world. The North American slowdown might just be a temporary blip, or it could be a sign of deeper, more fundamental shifts in consumer preferences. It’s something to keep an eye on.

The one thing you absolutely must remember when you interpret data like this is the context. For instance, maybe they are trying to innovate and adapt to changing consumer preferences, experimenting with healthier options and sustainable practices. According to their investor relations page (pepsico.com/investors), they are actively diversifying their portfolio. And that is a key to continued growth .

FAQ | Your Burning Questions About PepsiCo’s Sales Answered

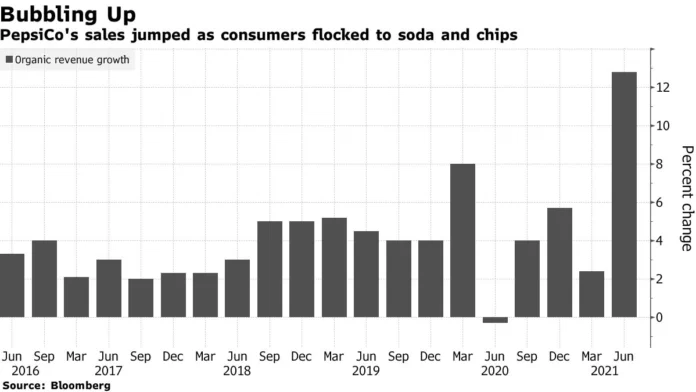

What exactly does “organic revenue growth” mean?

It refers to revenue growth excluding the impact of acquisitions, divestitures, and foreign exchange fluctuations. It provides a clearer picture of the company’s underlying performance.

Is PepsiCo’s stock a good investment right now?

That depends on your individual investment goals and risk tolerance. Do your research and consult with a financial advisor before making any decisions.

What are some of PepsiCo’s biggest competitors?

Coca-Cola, Nestle, and Unilever are among its main competitors in the food and beverage industry.

How is PepsiCo addressing concerns about health and sustainability?

They are investing in healthier product options, reducing sugar content in existing products, and exploring more sustainable packaging solutions.

What if I’m looking to avoid sugary drinks?

PepsiCo offers a variety of alternatives, including flavored water, sparkling water, and low-sugar options.

So, there you have it. PepsiCo’s Q3 results are a complex story, with both challenges and opportunities. But, by understanding the underlying trends and asking the right questions, we can gain a deeper appreciation for the company’s future prospects.