Let’s be honest, the world of pharmaceutical stocks can feel like a high-stakes game of chess. One minute, you’re riding high on promising trial data; the next, you’re navigating a sea of regulatory hurdles. Pfizer (PFE) is no exception. But what’s particularly fascinating about Pfizer right now – and why I’m writing this – is the sheer amount of change the company is undergoing. It’s not just about new drugs; it’s a fundamental shift in strategy. So, the real question isn’t just about the current stock price , it’s about whether this giant can successfully reinvent itself for a post-pandemic world.

The Pandemic Bump and the Subsequent Dip

Remember when Pfizer was the name everyone knew? The pandemic made it a household word, and its COVID-19 vaccine generated billions. But here’s the thing: that kind of revenue was never going to last forever. And, predictably, it hasn’t. As demand for vaccines and treatments wanes, Pfizer is facing the inevitable question: what’s next?

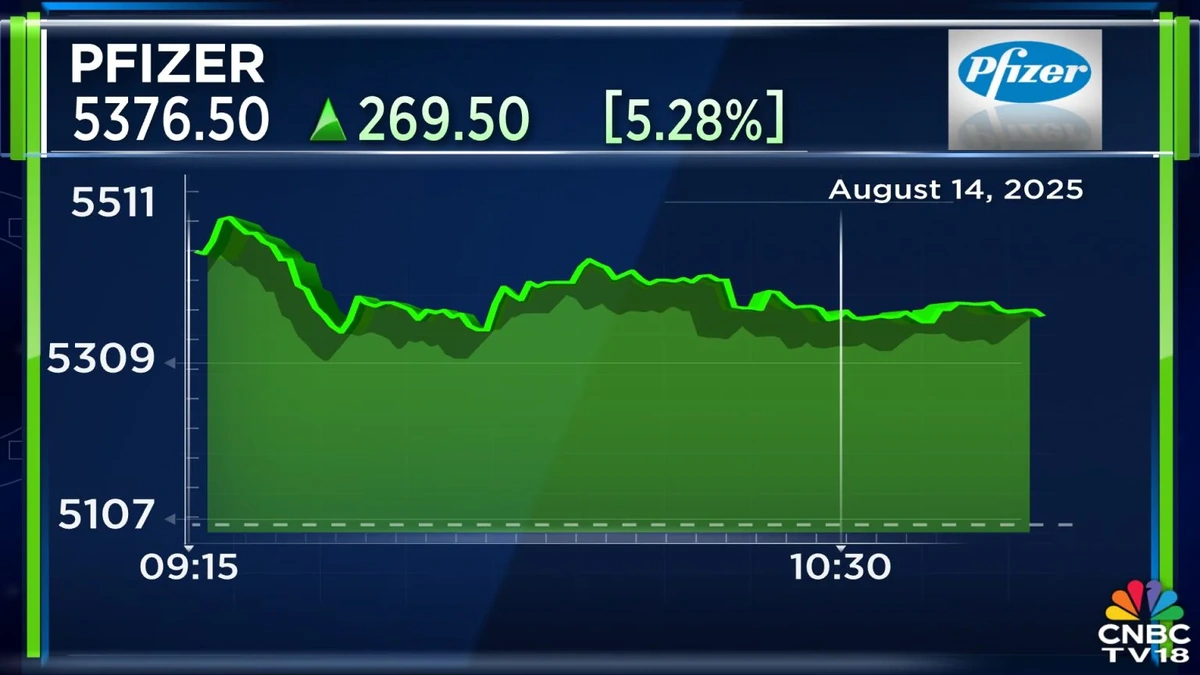

The revenue decline from COVID products has definitely impacted Pfizer’s share price. Investors are always forward-looking, and they’re trying to gauge whether Pfizer has a robust pipeline of new products to offset the drop. This is where things get interesting – and where the “buy, sell, or hold” decision becomes less straightforward.

Beyond COVID | Pfizer’s New Strategic Bets

Pfizer isn’t just sitting back and watching its COVID revenue disappear. The company is actively reshaping its portfolio through acquisitions and strategic partnerships. One notable example is their acquisition of Seagen, a leader in cancer treatments .According to a recent report in the Wall Street Journal , this move signals Pfizer’s commitment to expanding its oncology business. But, like any major acquisition, there are risks. Integrating Seagen, realizing synergies, and navigating the competitive landscape of cancer therapeutics will be critical.

But, let me rephrase that for clarity: Pfizer is betting big on oncology, and the Seagen acquisition is a cornerstone of that strategy. This is why paying attention to Pfizer’s progress in this area is so important.

And, Pfizer also has a range of other pipeline candidates across various therapeutic areas, including vaccines for other infectious diseases and treatments for inflammatory conditions. Success in these areas could diversify its revenue stream and reduce reliance on any single product.

Financial Health and Valuation | Digging into the Numbers

Of course, any investment decision requires a close look at the financials. Pfizer’s financial health is generally solid, but it’s essential to analyze key metrics such as revenue growth (or decline), earnings per share (EPS), and cash flow. A common mistake I see people make is focusing solely on the current stock price without understanding the underlying fundamentals.

The company’s valuation is another critical factor. Is the stock currently undervalued, overvalued, or fairly priced? This requires comparing Pfizer’s valuation multiples (e.g., price-to-earnings ratio) to those of its peers in the pharmaceutical industry . Keep in mind that valuation is subjective and can be influenced by market sentiment and investor expectations.

Risks and Opportunities | The Road Ahead for Pfizer

Like any investment, Pfizer stock comes with both risks and opportunities. On the risk side, there’s always the possibility of clinical trial failures, regulatory setbacks, and increasing competition. Drug development is inherently risky, and not every drug candidate will make it to market.

But, the opportunities are equally compelling. If Pfizer can successfully develop and launch new blockbuster drugs, expand its oncology business, and effectively manage its expenses, the stock could offer significant upside potential. What fascinates me is the scale of Pfizer’s ambition – they’re not just trying to maintain their position; they’re actively trying to redefine it. A common mistake I see is people not considering the potential of biosimilars too, as this area will expand greatly.

Also the recent partnership with Tiktok , might lead to potential marketing and PR oppurtunities.

FAQ | Your Burning Questions Answered

Frequently Asked Questions

What’s the biggest risk facing Pfizer right now?

The decline in COVID-19 revenue is a significant challenge, along with the integration of Seagen and the general risks inherent in drug development.

Is Pfizer a good long-term investment?

That depends on your risk tolerance and investment goals. Pfizer has the potential for long-term growth, but it also faces significant challenges.

How does Pfizer compare to other pharmaceutical stocks?

Pfizer is one of the largest pharmaceutical companies in the world, with a diverse portfolio of products and a global presence. However, it faces intense competition from other major players in the industry.

What if I’m already holding Pfizer stock?

Consider your original investment thesis and whether it still holds true. Reassess your risk tolerance and investment goals. Consult with a financial advisor if needed.

So, there you have it – a deeper dive into the world of Pfizer stock . It’s not a simple story of boom or bust; it’s a complex narrative of a company in transition. The future of Pfizer depends on its ability to navigate these challenges and capitalize on its opportunities. And the only way to know if it will be a successful endeavor is to do your homework and stay informed.