Okay, let’s talk about something that sounds straight out of a sci-fi movie but is very real: rare earth metals . No, we’re not talking about kryptonite. We’re talking about a group of 17 elements that are essential for everything from your smartphone to electric vehicles to, yep, even military applications. And guess what? The US and China are locked in a geopolitical tango over these crucial elements. It’s heating up, and frankly, it’s a big deal for India too.

Why Should India Care About Rare Earth Metals?

Here’s the thing: this isn’t just a squabble between two superpowers. India has skin in this game, big time. Think about it – India’s push for electric vehicles, its growing tech industry, and its own defense needs all rely on a steady supply of these strategic minerals . A disruption in the global supply chain, triggered by this trade war, could throw a wrench in India’s ambitious plans. According to a report by the Ministry of Mines , India is actively seeking to secure its own supply chains for these critical resources.

But, let’s be honest, India is currently heavily reliant on imports for many of these materials. And with China being a dominant player in the rare earth elements market, that reliance is a potential vulnerability. A common mistake I see analysts make is underestimating the long-term impact of these resource dependencies. The implications are far-reaching.

The China Factor | Dominance and Leverage

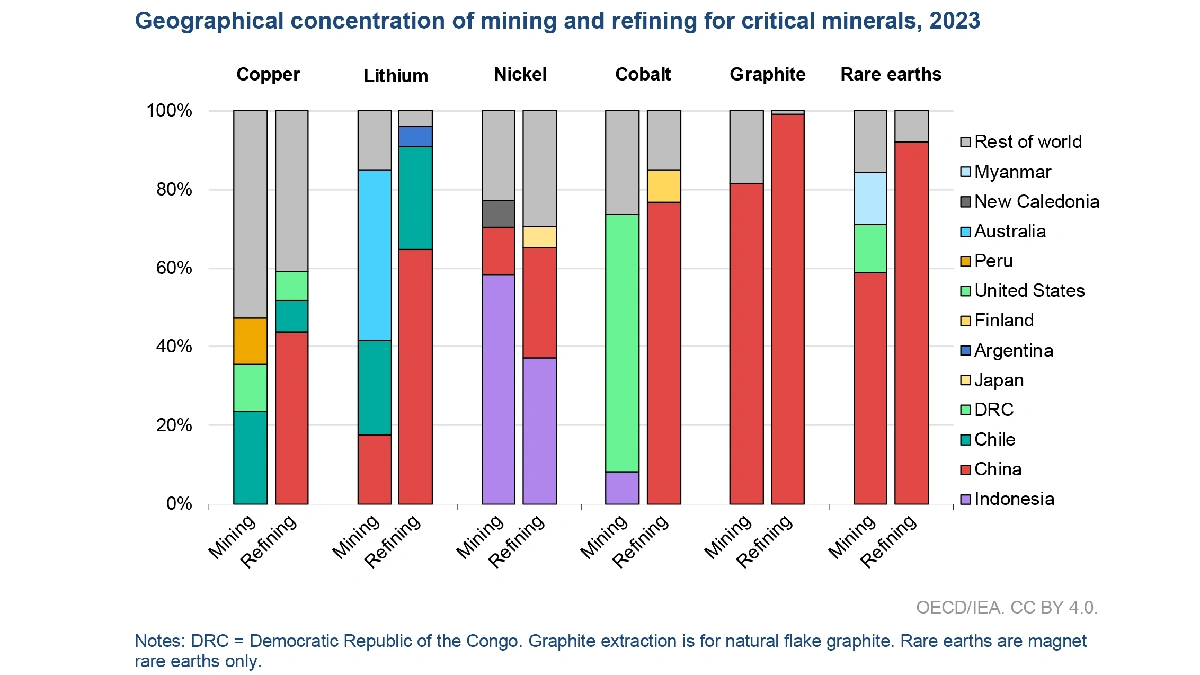

China currently controls a significant portion of the global rare earth supply chain. They have the mines, the processing facilities, and the know-how. This gives them considerable leverage in international trade and diplomacy. Now, when China starts talking about limiting exports – especially to a major competitor like the US – everyone sits up and takes notice. It’s like they’re holding all the aces in a high-stakes poker game.

And it’s not just about cutting off supplies. It’s about sending a message. A message that says, “We control this market, and we’re not afraid to use it.” What fascinates me is how this situation underscores the importance of diversifying supply chains. It’s not enough to have the money to buy these resources; you need to ensure you can actually get them when you need them.

The US Response | Playing Catch-Up

The US, realizing its vulnerability, is now scrambling to secure its own domestic rare earth metals supply. They’re investing in new mining projects, developing processing technologies, and trying to reduce their dependence on China. A recent article in the Wall Street Journal details the US government’s efforts to incentivize domestic production of these critical materials (Wall Street Journal) .

But here’s the thing: building a rare earth industry from scratch takes time and a boatload of investment. It’s not something that can happen overnight. And while the US is making progress, they’re still playing catch-up. I initially thought this was straightforward, but then I realized the geopolitical chess match is more complex. The US needs allies.

India’s Opportunity | A Strategic Partnership?

This is where India comes in. India has significant reserves of rare earth minerals , particularly monazite sands found along its coast. The challenge is that these resources haven’t been fully exploited yet. The technology and investment needed to extract and process these materials are substantial. But – and this is a big but – this also presents a massive opportunity for India. Developing its own rare earth processing capabilities could not only reduce its dependence on imports but also position it as a key player in the global market. As per the guidelines mentioned in the information bulletin from the Ministry of Mines, India is actively seeking collaborations to boost domestic production.

And, look, a partnership with the US could be a win-win situation. The US needs a reliable source of rare earths, and India needs the technology and investment to develop its resources. It’s a match made in geopolitical heaven, almost. But the road ahead will not be easy .

Navigating the Future | India’s Rare Earth Strategy

So, what should India do? It’s simple, but not easy. The country needs a comprehensive rare earth metals strategy that focuses on three key areas:

- Investing in exploration and mining to identify and exploit its domestic resources.

- Developing processing technologies to extract and refine rare earth elements efficiently and sustainably.

- Forging strategic partnerships with countries like the US to secure access to technology and markets.

Let me rephrase that for clarity: India needs to be proactive, not reactive. They can’t afford to sit on the sidelines and watch this trade war play out. They need to get in the game and secure their own future. The current situation is a wake-up call, and India must answer it decisively. But, a common mistake I see people make is to not consider the environmental impact of mining and processing these resources. Sustainability must be a key consideration.

And the stakes are high . The global race for rare earths is on, and India needs to be in it to win it.

FAQ About Rare Earth Elements

Why are rare earth metals so important?

Rare earth metals are essential for manufacturing a wide range of high-tech products, including smartphones, electric vehicles, wind turbines, and defense systems.

Where are rare earth metals found?

They are found in various locations around the world, but China currently dominates the global production and processing of these elements.

What is India’s role in the rare earth metals market?

India has significant reserves but needs to develop its mining and processing capabilities to become a major player. India is actively seeking to secure its own supply chains for these critical resources.

What are the environmental concerns associated with rare earth mining?

Rare earth mining can have significant environmental impacts, including habitat destruction, water pollution, and radioactive waste. Sustainable mining practices are essential.

How can India secure its rare earth supply chain?

India can secure its supply chain by investing in domestic mining and processing, forging strategic partnerships with other countries, and promoting sustainable mining practices.

One last thought: this isn’t just about metals and technology. It’s about economic security, national security, and the future of India in a rapidly changing world. The decisions made today will determine India’s place in the global order for decades to come.