Alright, let’s talk about what’s happening in the stock market. No, really, let’s dig in . It’s not just about numbers flashing on a screen; it’s about understanding the undercurrents, the “why” behind the “what.” So, grab your chai, and let’s break down this recent stock market plunge and what it means, especially for us here in India.

Decoding the Dip | Why Is This Happening?

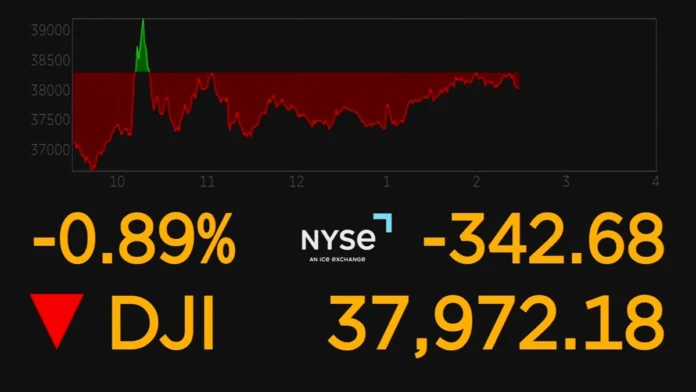

Here’s the thing: when the Dow Jones Industrial Average, S&P 500, and Nasdaq all take a hit simultaneously, you know something’s up. But what exactly? Well, it’s multi-layered, like a perfectly made biryani. Firstly, the tech sector, which has been the darling of investors for ages, is facing a reality check. Rising interest rates? Yeah, those are playing a significant role. They make borrowing more expensive, which can slow down growth for these companies. As per reports, many analysts believe that the tech sector was overvalued, which is now finding a new balance.

But wait, there’s more! Global economic uncertainty is also a significant factor. With geopolitical tensions simmering and inflation still being a global headache, investors are getting jittery. They tend to pull back from riskier assets like tech stocks and move towards safer havens. It’s like when you see dark clouds gathering; you instinctively seek shelter, right?

Tech’s Troubles | More Than Just Numbers

Now, let’s zoom in on the tech sector’s woes. This isn’t just about stock prices; it impacts us directly. Many Indian IT companies and tech startups are deeply integrated into the global tech ecosystem. A slowdown in the US tech market can mean fewer projects, potential layoffs, and a ripple effect across the Indian IT landscape. Tech stocks may be very volatile in the short-term.

And it’s not just the big players. Think about the countless Indian entrepreneurs who’ve built their businesses on the back of platforms like Amazon, Google, and Facebook. When these giants stumble, it creates uncertainty for everyone. That’s why understanding these global trends is crucial – it’s about knowing how they affect your business, your job, and your investments. Let’s be honest, these impacts may be severe or less severe, depending on the company.

Let me rephrase that for clarity: the tech sector’s dip isn’t just some abstract financial news. It’s a real-world event with tangible consequences. The performance of S&P 500 is correlated with these impacts.

Navigating the Volatility | What Should You Do?

So, what’s an investor to do? Panic and sell everything? Absolutely not! Remember, the stock market is a marathon, not a sprint. Volatility is part of the game. The key is to stay calm, stay informed, and make rational decisions. In the words of Warren Buffet, “Be fearful when others are greedy and greedy when others are fearful.” Easier said than done, right? But here are a few practical tips:

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across different sectors and asset classes.

- Stay Informed: Keep up with market news and analysis. Understand the factors driving the market, but don’t get swayed by short-term noise.

- Invest for the Long Term: If you’re a long-term investor, don’t panic sell during market downturns. In fact, this could be an opportunity to buy quality stocks at a discount.

- Consult a Financial Advisor: If you’re unsure about your investment strategy, seek advice from a qualified financial advisor.

A common mistake I see people make is reacting emotionally to market fluctuations. Remember, market corrections are normal and healthy. They create opportunities for long-term growth. The key is to be prepared and stay disciplined.

The Indian Angle | Opportunities and Challenges

Now, let’s bring it back home. What does this Dow , S&P 500 and Nasdaq volatility mean for India specifically? On one hand, it presents challenges. As mentioned earlier, the Indian IT sector could face headwinds. Foreign portfolio investors (FPIs) might pull out money, putting pressure on the rupee. The price of Nasdaq stocks is also impacted.

But here’s the thing: every crisis presents an opportunity. A weaker rupee could boost exports. Indian companies with strong fundamentals could attract foreign investment. And, perhaps most importantly, this volatility serves as a wake-up call for Indian investors to become more sophisticated and strategic.

I initially thought this was straightforward, but then I realized the Indian stock market is closely linked with global markets. A global economic uncertainty can affect Indian economic performance. The more the investor is aware of these facts, the more benefits he/she can get.

According to data from the Bombay Stock Exchange (BSE), Indian retail investors have been increasing their participation in the stock market. This is a positive trend, but it also means more people need to understand the risks and rewards involved. It’s crucial to invest wisely and not get carried away by hype or fear.

Looking Ahead | The Future of the Market

So, where do we go from here? Predicting the market is a fool’s game. But we can make informed guesses based on current trends and data. I think the tech sector will continue to face challenges in the near term, but it will also adapt and innovate. The global economy will likely remain volatile, but it will also present opportunities for growth. Remember that stock market has ups and downs. The best approach is to be patient and wait for the right opportunity to come along.

And what fascinates me is that the Indian stock market will likely continue to grow, driven by a rising middle class, increasing financial literacy, and a growing entrepreneurial ecosystem. However, it will also face challenges such as regulatory hurdles, infrastructure bottlenecks, and global economic uncertainty.

As per a report by the Securities and Exchange Board of India (SEBI), efforts are being made to improve regulatory frameworks and protect investors. It’s best to keep checking the official portal for updated circulars.

Remember, the key to success in the stock market is not about timing the market, but about time in the market. Invest wisely, stay informed, and be patient. And don’t forget to enjoy the ride. After all, investing should be exciting, not stressful!

FAQ Section

What if I am new to the stock market?

Start small, educate yourself, and don’t invest more than you can afford to lose.

How often should I check my portfolio?

Checking it once a month is generally sufficient, unless there are significant market events.

What are some good resources for learning about the stock market?

Websites like Investopedia and the SEBI website are great resources.

Is now a good time to invest in the stock market?

It depends on your individual circumstances. Consult a financial advisor for personalized advice.

In conclusion, the recent stock market plunge is a reminder that the market is unpredictable. But it’s also an opportunity to learn, adapt, and grow. By staying informed, staying disciplined, and focusing on the long term, you can navigate the volatility and achieve your financial goals. The other key is to find the right time for investment.