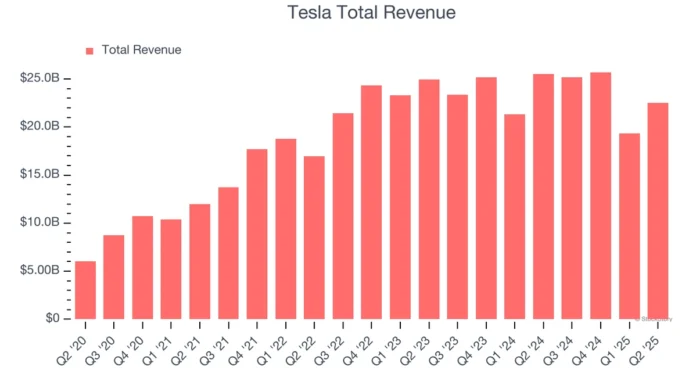

Alright, folks, let’s dive into something juicy. Tesla Profit , the electric car giant that seems to be constantly breaking records, just hit a bit of a speed bump. They sold a ton of cars – like, a record number – but their profits? Not so hot. They actually took a plunge. What gives?

Why Tesla’s Record Sales Didn’t Translate to Record Profits

Here’s the thing: selling more stuff doesn’t always mean making more money. Tesla is facing a triple whammy of problems that are eating into their profit margins . Let’s break it down, because it’s more complicated than just saying “costs went up.” I initially thought this was straightforward, but then I realized the interplay of factors is really interesting.

First, there’s the rising cost of, well, everything. Raw materials, batteries, labor – you name it, it’s getting pricier. Supply chain issues , which have been plaguing the entire automotive industry for the past couple of years, are still a major headache. Getting the parts they need to build those sleek EVs is costing Tesla more than ever.

Second, and this is a big one, government incentives for electric vehicles are starting to fade. These credits, which used to give a nice little boost to Tesla’s bottom line, are becoming less generous or disappearing altogether. It’s like the government said, “Okay, you’re doing great on your own now; good luck!”

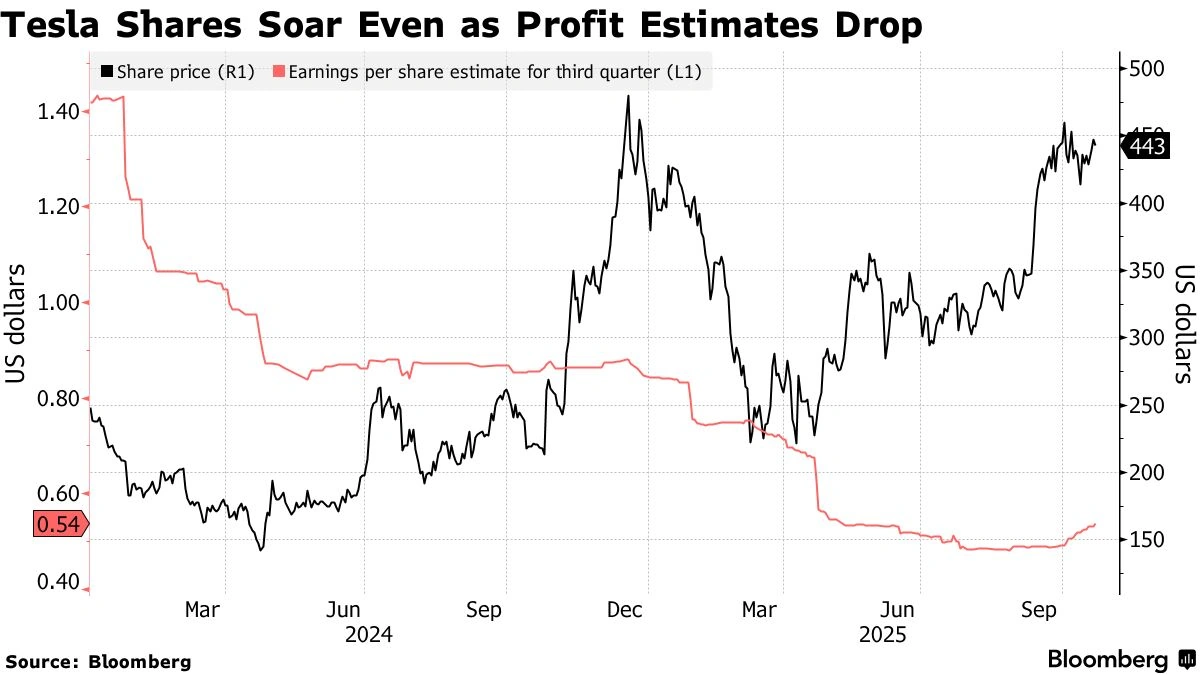

Third, Tesla has been cutting prices on its vehicles to maintain its market share. In a market that’s becoming increasingly competitive – everyone from established automakers like Ford and GM to new players like Rivian and Lucid are getting in on the EV action – Tesla can’t just sit back and expect customers to keep flocking to its cars, especially with electric vehicle competition heating up.

Decoding the Impact on the Indian Market

Now, you might be thinking, “Okay, that’s happening in America. Why should I care?” Well, here’s why: what happens to Tesla globally always has ripple effects, even here in India. Tesla’s struggles with profitability could delay their entry into the Indian market, or it could mean higher prices for their cars when they finally do arrive. Think about it – they need to recoup those rising costs somewhere, right?

And it’s not just about Tesla. This situation is a warning sign for the entire EV industry. If even the mighty Tesla is feeling the pinch, it means that the transition to electric vehicles is going to be more expensive and more challenging than we thought. It could impact the pace of EV adoption in India, especially if government subsidies don’t keep pace. Related to autos and tech.

But, before you get too gloomy, let’s be clear: Tesla is still selling a ton of cars. They’re still the undisputed leader in the EV market. This is more of a course correction than a full-blown crisis. But it’s a reminder that even the most innovative companies face challenges, and that the road to an all-electric future is likely to be bumpy.

The Future of Tesla | Navigating the Headwinds

So, what’s next for Tesla? How will they navigate these challenges and get back on the path to higher profits? Well, that’s the million-dollar question. Let’s be honest, nobody knows for sure, but here are a few things to watch for:

Cost Cutting Measures: Expect Tesla to double down on efforts to reduce its production costs. That could mean anything from renegotiating contracts with suppliers to streamlining its manufacturing processes. Elon Musk is famous for his relentless focus on efficiency, and you can bet he’s already cracking the whip.

Battery Technology Innovation: Batteries are the most expensive part of an EV, so any breakthroughs in battery technology could have a huge impact on Tesla’s profitability. They’re constantly working on new battery chemistries and manufacturing techniques to bring down costs and improve performance.

New Model Launches: Tesla needs to keep its product lineup fresh and exciting to maintain its lead in the EV market. The Cybertruck, whenever it finally arrives, could be a major catalyst for growth. It is important to mention that new model demand may reduce price competition.

Expansion into New Markets: India is a huge potential market for Tesla, but it’s also a challenging one. They’ll need to find the right strategy to succeed here, whether that means building a local factory, partnering with an Indian company, or something else entirely. It’s a high-stakes gamble.

Also, let’s not forget Tesla’s other ventures, like energy storage and solar panels. These businesses could become increasingly important sources of revenue in the years to come. Elon Musk isn’t putting all his eggs in one basket.

And, finally, the elephant in the room: Elon Musk himself. His leadership, his vision, and his sometimes-erratic behavior all have a huge impact on Tesla’s success. Whether you love him or hate him, you can’t deny that he’s a force to be reckoned with.

The Global EV Landscape

Zooming out a bit, the Tesla situation reflects a broader trend in the electric vehicle space. We’re moving beyond the early adopter phase, where people were willing to pay a premium for EVs simply because they were cool and environmentally friendly. Now, EVs have to compete on price, performance, and features with traditional gasoline-powered cars.

This is a good thing for consumers, because it means we’re going to see better and more affordable EVs in the years to come. But it also means that the companies that succeed in this new environment will be the ones that can innovate, cut costs, and deliver real value to customers. Tech and innovation.

The key here is how they will navigate the intricacies of the global economy . It’s all interconnected, even if it doesn’t seem like it on the surface.

Conclusion | What Does It All Mean?

So, what’s the takeaway from all of this? Tesla’s profit plunge is a reminder that even the most successful companies aren’t immune to challenges. The EV market is evolving, and Tesla needs to adapt to stay ahead of the game. But, while there may be a few bumps on the road, the long-term trend toward electric vehicles is still clear. The future is electric; it’s just a question of how we get there.

FAQ About Tesla’s Financial Performance

Why are Tesla’s profits down despite record sales?

Rising costs of raw materials, fading government incentives, and price cuts to maintain market share are all contributing factors.

How might Tesla’s struggles affect the Indian market?

It could delay Tesla’s entry into India or lead to higher prices for their cars when they eventually arrive.

What is Tesla doing to address its profitability challenges?

They are focusing on cost-cutting measures, battery technology innovation, and expanding into new markets.

Is Elon Musk still a key factor in Tesla’s success?

Yes, his leadership, vision, and behavior continue to have a significant impact on the company.

How competitive is the electric vehicle market?

The EV market is becoming increasingly competitive, with more established automakers and new players entering the space.

What are some potential catalysts for Tesla’s future growth?

New model launches (like the Cybertruck) and expansion into new markets (like India) could drive growth.