Tesla stock . Just the name conjures up images of sleek electric vehicles, visionary CEOs, and, let’s be honest, a fair bit of market volatility. Here’s the thing: understanding Tesla’s stock isn’t just about following the daily numbers. It’s about understanding the future of transportation, energy, and even, to some extent, the ambitions of humanity itself. What fascinates me is how much of the stock price is based not on current performance, but future potential.

The “Why” Behind the Swings | More Than Just Car Sales

So, you see Tesla’s stock price jump (or plummet) and immediately think, “Oh, they sold a lot of cars this quarter!” Or maybe, “Elon tweeted something again…” While those factors certainly play a role, the real “why” goes much deeper. It’s about investor confidence in Tesla’s long-term vision. Are they still seen as the leader in the EV market? Are their investments in battery technology paying off? Is their expansion into energy solutions gaining traction? These are the questions analysts are wrestling with, and their answers dramatically affect the TSLA stock forecast .

Consider this: Tesla isn’t just a car company. They’re a tech company, an energy company, and even, arguably, an AI company. Their autonomous driving efforts, their battery storage solutions (like the Powerwall and Megapack), and their ongoing innovations in manufacturing are all factored into the stock price. When assessing Tesla’s market capitalization , these elements are paramount.

Navigating the Volatility | Are You Ready to Ride?

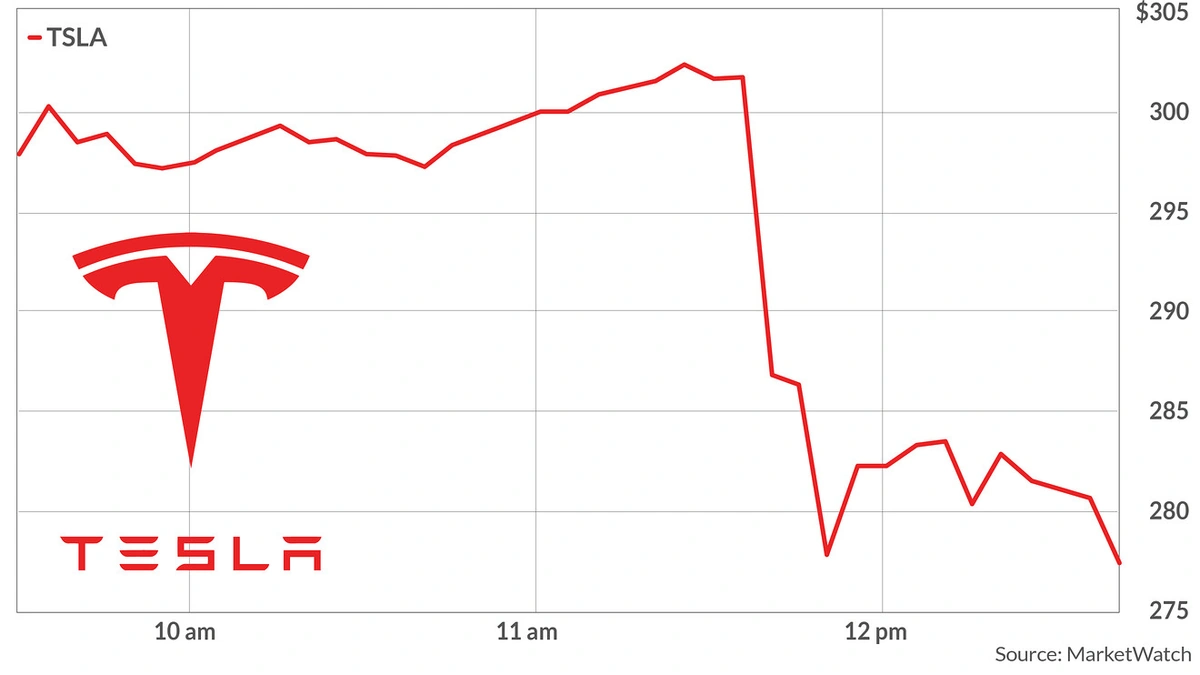

Let’s be frank: TSLA stock price can be like a bucking bronco. Huge ups, followed by equally dramatic downs. What makes it so volatile? A number of factors. Elon Musk’s tweets (yes, still). Changes in government regulations regarding electric vehicles and renewable energy. Competition from other automakers entering the EV space. And, of course, broader economic trends.

A common mistake I see people make is trying to time the market with Tesla. They think they can buy low and sell high based on short-term news. That’s a dangerous game. Instead, consider your risk tolerance and your investment horizon. Are you in it for the long haul? Or are you looking for a quick profit? If you’re risk-averse, Tesla might not be the best fit. But, if you believe in the company’s long-term potential and can stomach the volatility, it could be a rewarding investment. Hyundai and other companies are emerging competitors and investors should weigh all companies when considering entering the market.

The Future is Electric (and Automated?) | Tesla’s Long-Term Potential

What fascinates me is how Tesla is positioning itself for the future. It’s not just about selling more cars. It’s about building a complete ecosystem of sustainable energy solutions. Think solar panels on your roof, a Powerwall in your garage, and an electric car in your driveway, all seamlessly integrated.

But it goes even further. Tesla’s investments in autonomous driving technology could revolutionize transportation as we know it. Imagine a world where cars drive themselves, reducing accidents and freeing up our time. It may seem like science fiction, but Tesla is actively working to make it a reality. The potential of Tesla’s autonomous driving program is a key element influencing the overall stock evaluation.

Of course, there are challenges. Competition is intensifying, and Tesla’s manufacturing processes have faced scrutiny. But, the company’s relentless pursuit of innovation and its commitment to sustainability give it a significant advantage.

Beyond the Hype | Making an Informed Decision

So, you’re thinking about investing in Tesla? Don’t just listen to the hype. Do your homework. Research the company’s financials. Understand its business model. Assess its competitive landscape. Read analysis from reputable sources. And, most importantly, consider your own investment goals and risk tolerance. A common mistake is ignoring analyst ratings for Tesla before investing.

And, a crucial factor is considering EV market trends generally before making decisions about this stock.

Let me rephrase that for clarity… It is not gambling, it is investing. Don’t invest money you can’t afford to lose. Remember, past performance is not indicative of future results. But, with careful research and a long-term perspective, investing in Tesla could be a rewarding journey.

FAQ | Your Tesla Stock Questions Answered

What factors are most affecting the Tesla stock?

Investor confidence in Tesla’s long-term vision, sales figures, and Elon Musk’s public statements all affect the stock.

Is Tesla stock a good long-term investment?

That depends on your risk tolerance and belief in Tesla’s long-term potential.

What are the major risks associated with Tesla stock?

Competition from other automakers, manufacturing challenges, and regulatory changes all pose risks.

Where can I find reliable information about Tesla stock?

Reputable financial news outlets, analyst reports, and Tesla’s investor relations website are all good sources.

Tesla is leading in electric vehicle innovation, which will provide strong upward pressure.

Investing in the stock market has inherent risks, and you should consult a professional if you are unsure. Be careful when assessing your financials.