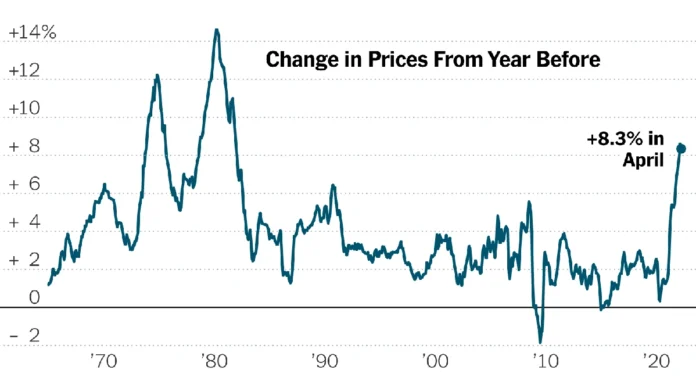

For a century, the U.S. has reliably published inflation data , offering a crucial snapshot of the economy. But, here’s the thing: that uninterrupted streak might be about to snap. Imagine a world where this consistent stream of information suddenly dries up. What happens then? Let’s dive into why this matters, especially for us here in India, where economic indicators are watched with hawk-like intensity.

Why This Matters | More Than Just Numbers

See, it’s easy to glaze over numbers, but inflation data is the lifeblood of economic planning. It influences everything from interest rates to investment decisions. If the U.S., a global economic powerhouse, falters in providing this data, the ripples will be felt across the globe. And India, deeply intertwined with the U.S. economy, would certainly feel it. A lack of reliable data breeds uncertainty, and uncertainty? Well, that’s the enemy of stable growth.

But, it’s not just about the macro-level impact. Think about the average Indian investor with holdings in U.S. markets. Their decisions are, in part, informed by this data. No data, no informed decisions, more risk. Here’s a related news.

The Potential Impact on India

India’s economic ties with the U.S. are substantial. We’re talking about trade, investments, and remittances. A disruption in the flow of U.S. economic data could lead to:

- Increased volatility in Indian markets

- Difficulty in forecasting economic trends

- A more cautious approach from Indian investors

What fascinates me is the potential for a domino effect. The U.S. hesitates, India reacts, and suddenly, the global economic landscape looks a lot less predictable. This also shows the importance of data collection methods .

How This Could Happen | The Funding Factor

The reason behind this potential disruption? Funding. Government agencies responsible for collecting and publishing inflation metrics rely on consistent funding. If that funding is threatened, data collection suffers. According to reports, budget cuts could severely impact the Bureau of Labor Statistics (BLS), the agency responsible for the Consumer Price Index (CPI), a key measure of inflation.

Let me rephrase that for clarity: imagine your local municipal corporation suddenly running out of money to collect garbage. Pretty soon, you’ve got a problem. Same principle here, just on a much grander scale. The impact of funding for economic data is crucial to keep the economy going.

Navigating Uncertainty | What Can We Do?

So, what can the average Indian do? Knowledge is power. Stay informed about the situation, diversify your investments, and consult with financial advisors. It’s always better to be prepared than caught off guard. Pay attention to alternative indicators to measure inflation rate .

The one thing you absolutely must consider is the long-term implications. This isn’t just a short-term blip. It could be a sign of deeper structural issues within the U.S. economy. We need to also look at the GDP growth and other economic factors.

The Bigger Picture | A Global Wake-Up Call

This situation serves as a wake-up call for all nations. Reliable economic data is not a luxury; it’s a necessity. Governments need to prioritize funding for statistical agencies and ensure their independence. And we, as global citizens, need to demand transparency and accountability from our leaders. TheBureau of Labor Statisticsis a great source for information.

I initially thought this was a straightforward issue of funding, but then I realized it’s about something much bigger: the integrity of economic information. And without that integrity, we’re all navigating in the dark.

But, so, this situation shines a light on the importance of other economic indicators and federal reserve decisions, which may be affected by the absence of the consumer price index.

FAQ Section

Frequently Asked Questions

What exactly is inflation data?

It’s information that measures the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling.

Why is U.S. inflation data important for India?

The U.S. is a major economic partner, and its economic health impacts India through trade, investment, and global market stability.

What happens if the U.S. stops publishing this data?

It creates uncertainty, increases market volatility, and makes economic forecasting more difficult.

Is there anything India can do to mitigate the impact?

Yes, India can focus on strengthening its own data collection mechanisms and diversifying its economic partnerships. See trending news.

Where can I find reliable economic data?

Look to reputable sources such as government agencies, international organizations, and established financial institutions.

In conclusion, the potential disruption of U.S. inflation data is a serious issue that demands our attention. It’s a reminder that economic stability depends on reliable information, and we must all play our part in safeguarding it. It’s crucial to understand the long term economic consequences .